How to Trade and Withdraw Funds from Binomo

How to Trade with Binomo

What is an asset?

An asset is a financial instrument used for trading. All trades are based on the price dynamic of a chosen asset. There are different types of assets: goods (GOLD, SILVER), equity securities (Apple, Google), currency pairs (EUR/USD), and indices (CAC40, AES).

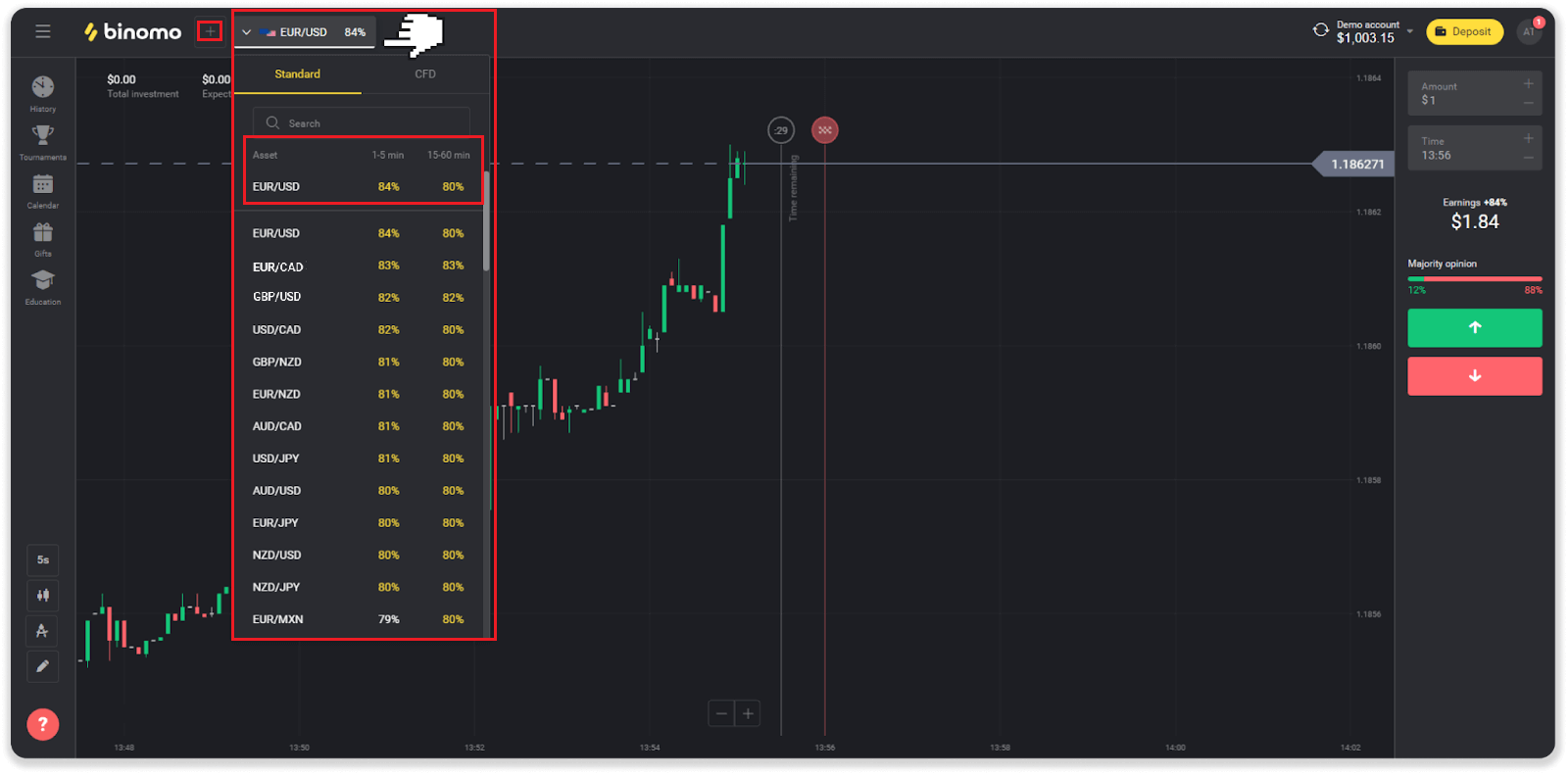

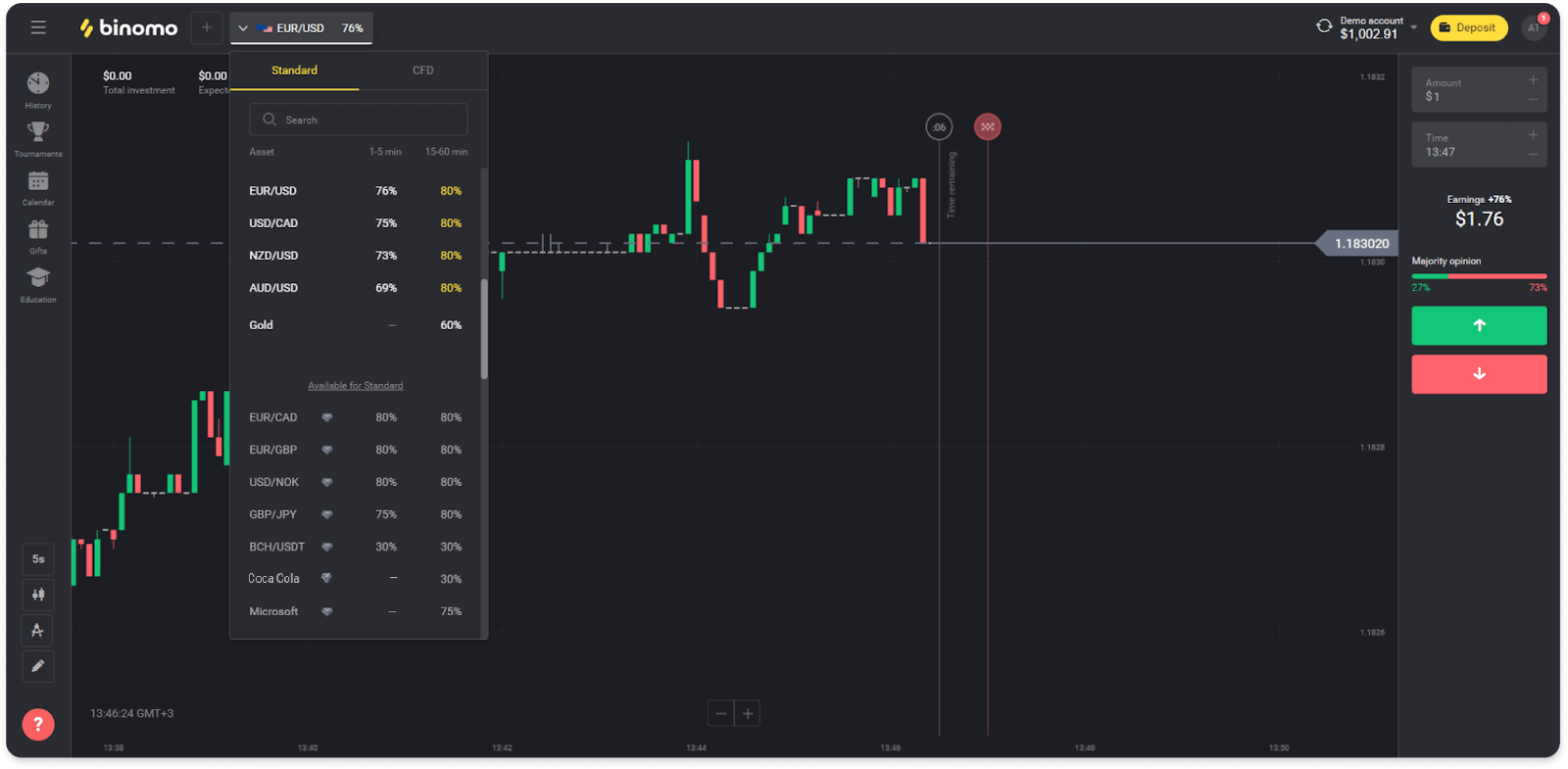

To choose an asset you want to trade on, follow these steps:

1. Click on the asset section in the top left corner of the platform to see what assets are available for your account type.

2. You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

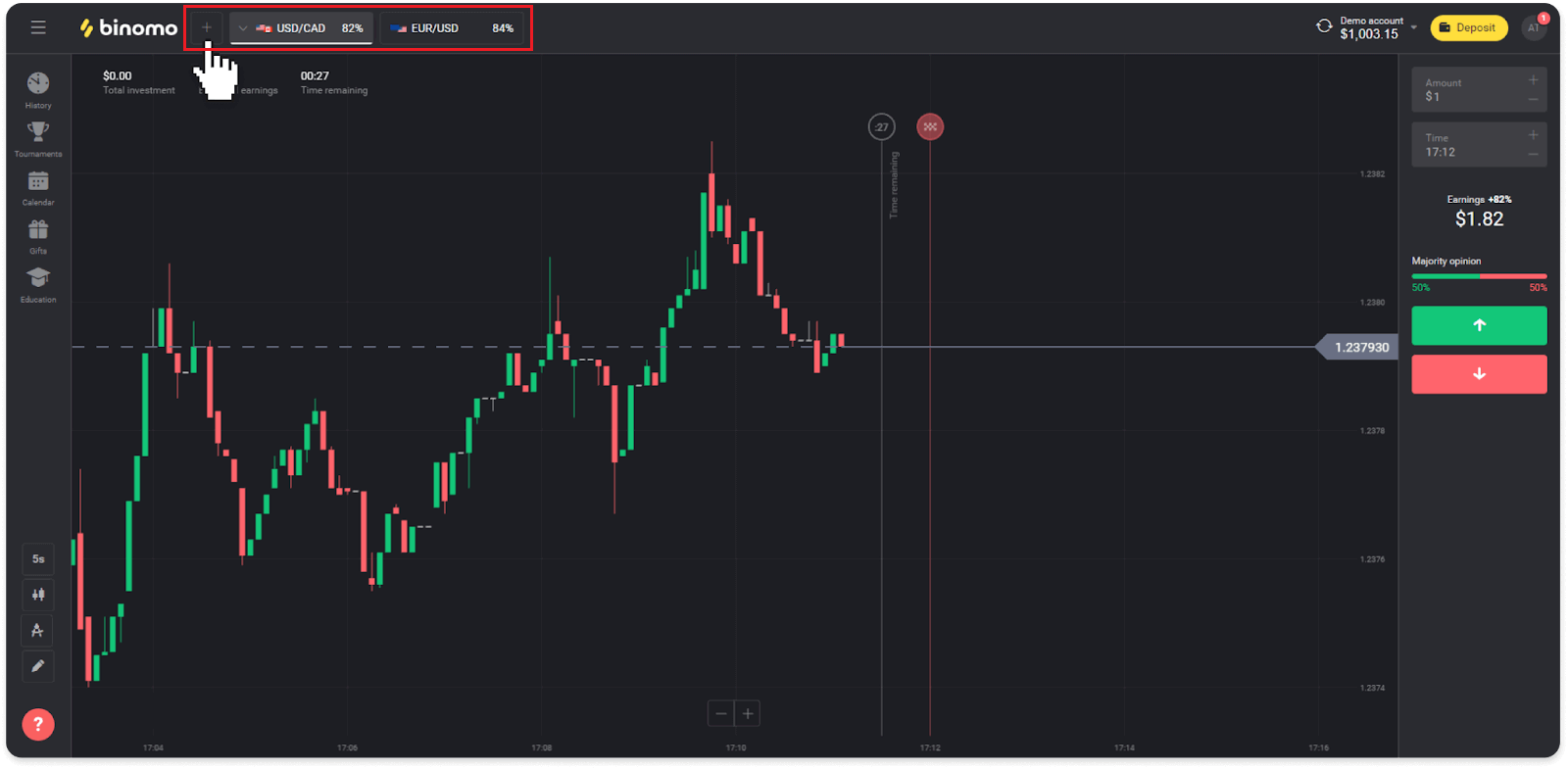

3. If you’re using the web version of a platform, you can trade on multiple assets at once. Click on the “+” button left from the asset section. The asset you choose will add up.

How to open a trade with Binomo?

When you trade, you decide whether the price of an asset will go up or down and get additional profit if your forecast is correct.To open a trade, follow these steps:

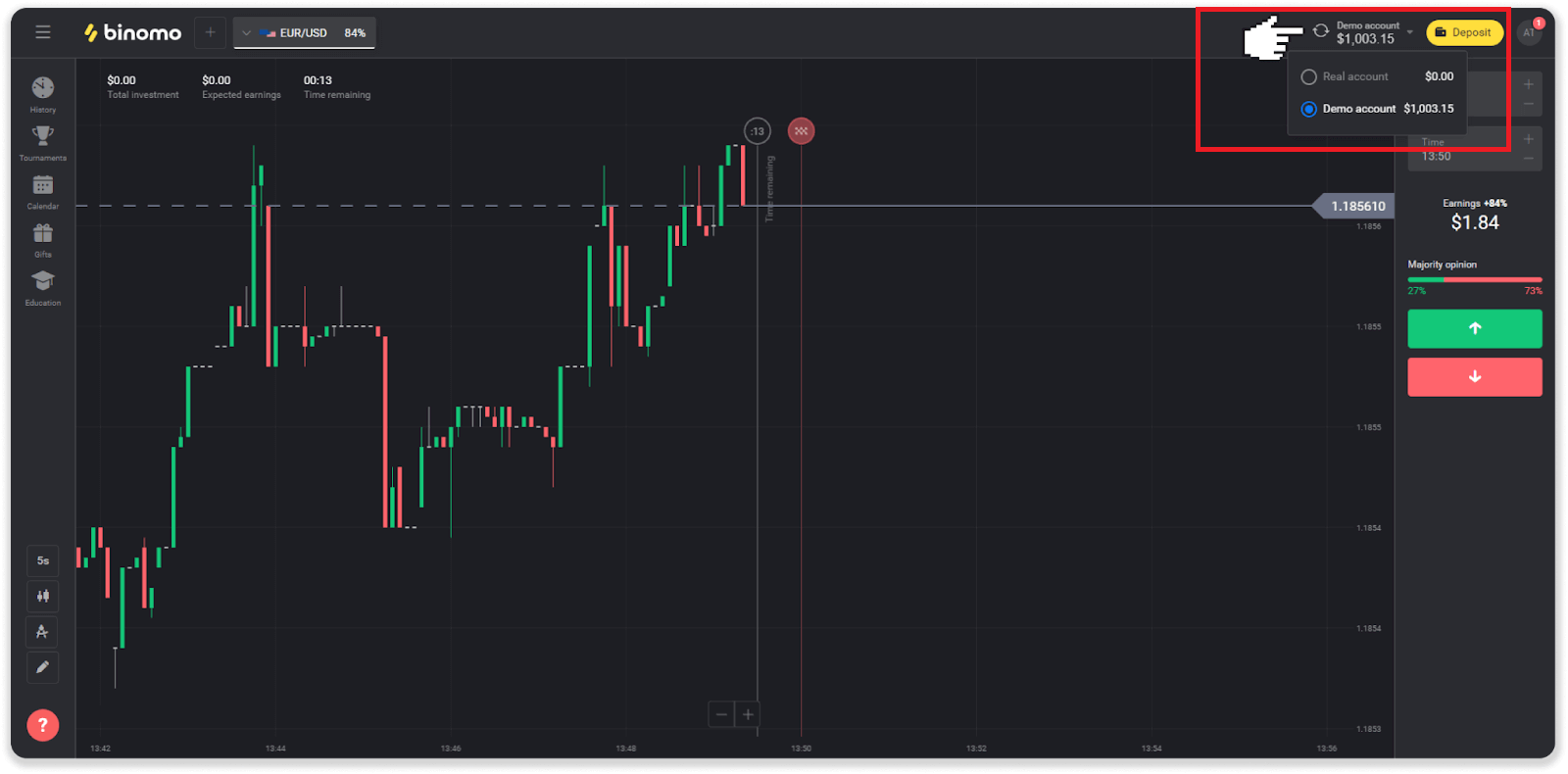

1. Select an account type. If your goal is to practice trading with virtual funds, choose a demo account. If you’re ready to trade with real funds, choose a real account.

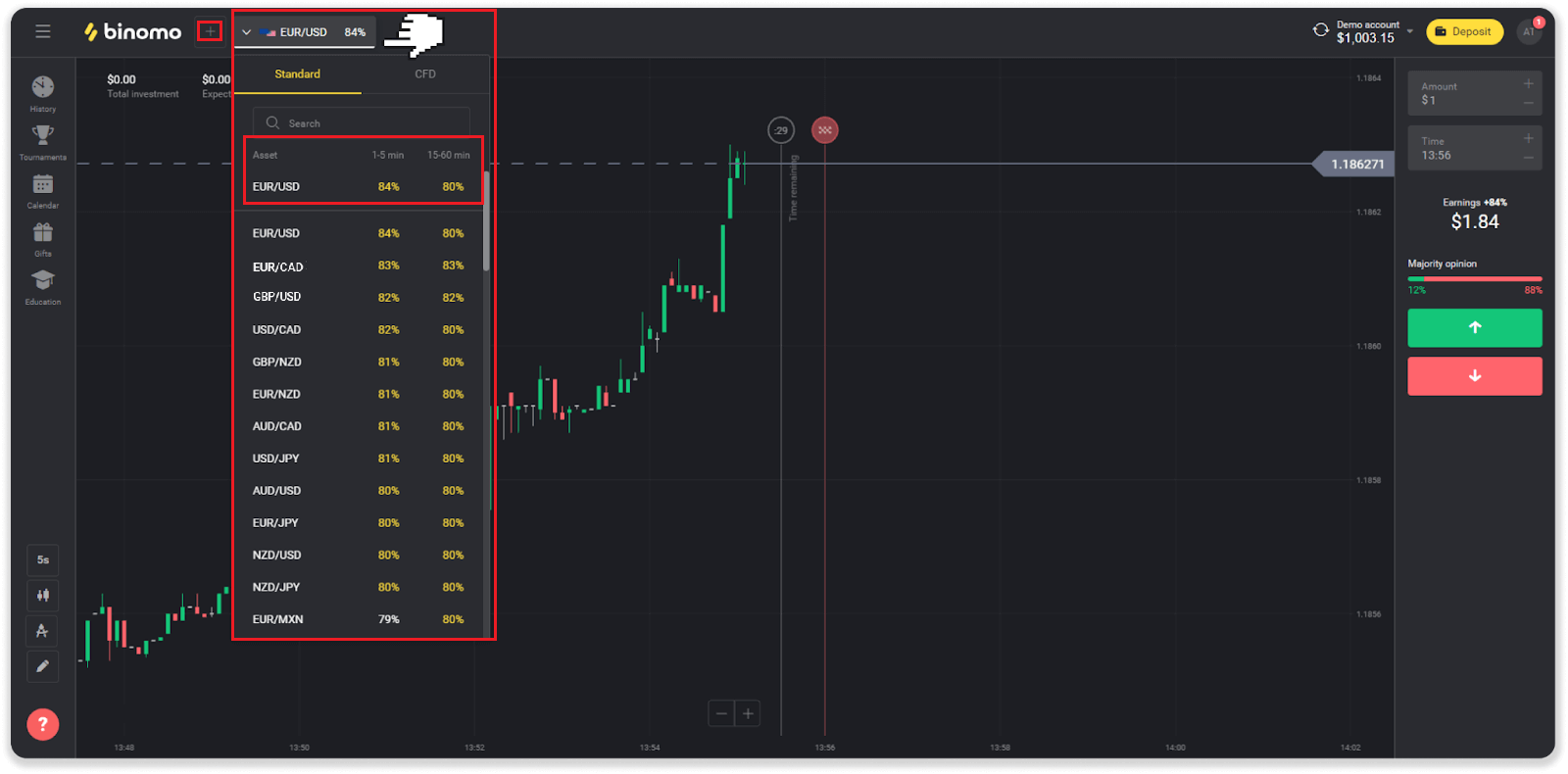

2. Select an asset. The percentage next to the asset determines its profitability. The higher the percentage – the higher your profit in case of success.

Example. If a $10 trade with a profitability of 80% closes with a positive outcome, $18 will be credited to your balance. $10 is your investment, and $8 is a profit.

Some asset’s profitability may vary depending on the expiration time of a trade and throughout the day depending on the market situation.

All trades close with the profitability that was indicated when they were opened.

Please note that the income rate depends on the trading time (short – under 5 minutes or long – over 15 minutes).

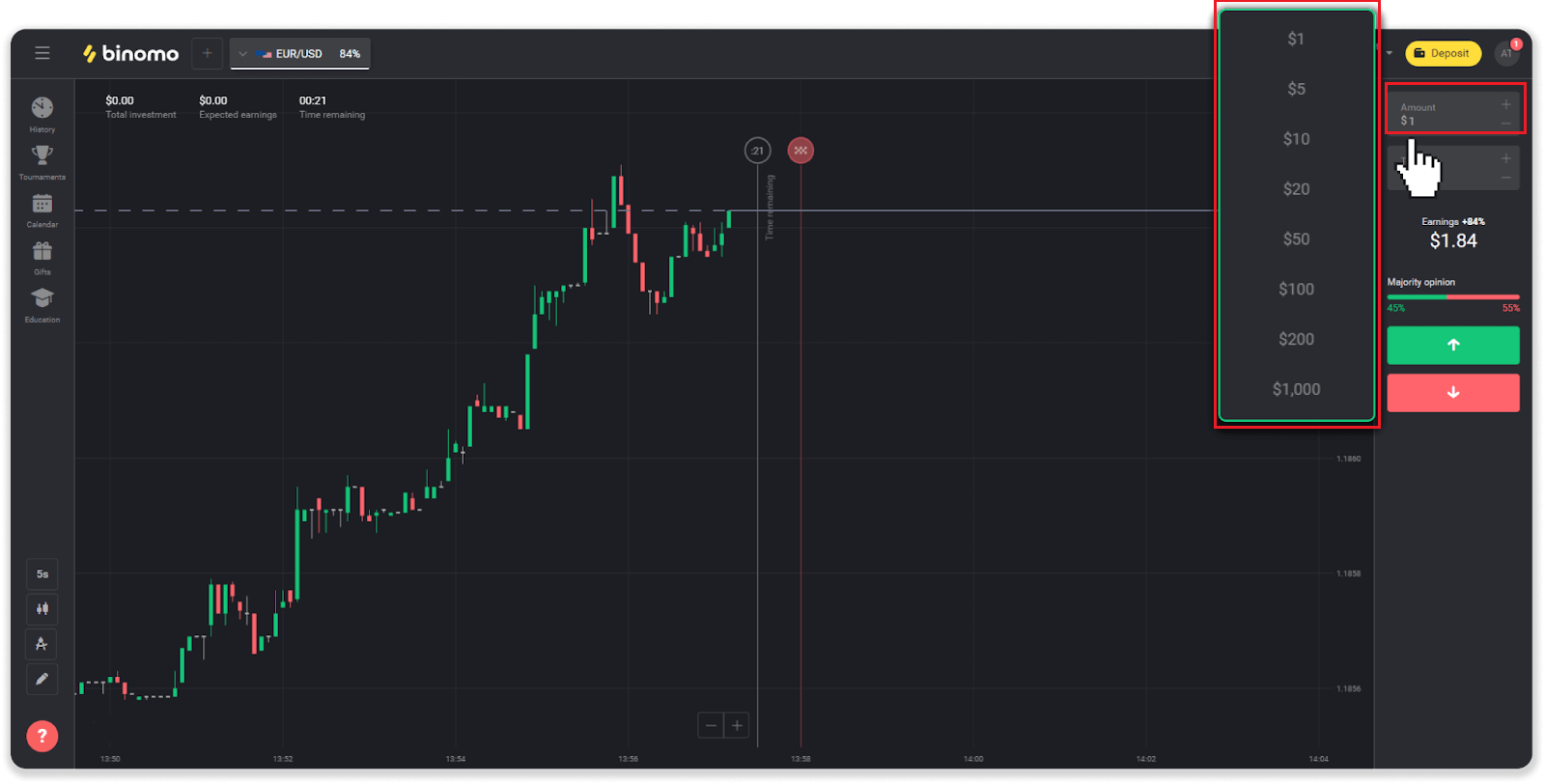

3. Set the amount you’re going to invest. The minimum amount for a trade is $1, the maximum – $1000, or an equivalent in your account currency. We recommend you start with small trades to test the market and get comfortable.

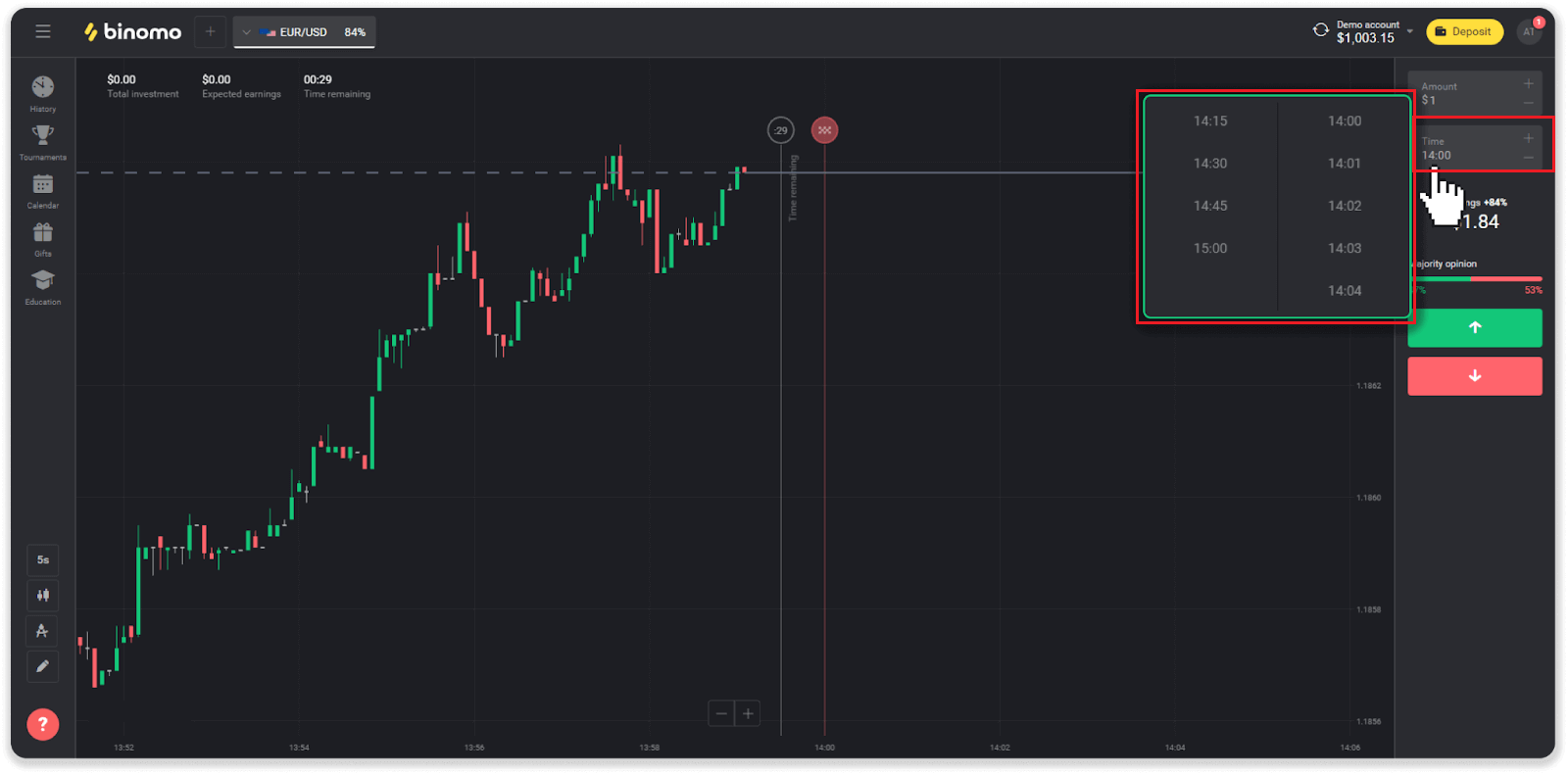

4. Select an expiration time for a trade

Expiration time is the time to end the trade. There’s a lot of expiration time for you to choose: 1 minute, 5 minutes, 15 minutes, etc. It is safer for you to begin with a 5-minute time period, and 1$ for each trading investment.

Please note that you choose the time the trade will close, not its duration.

Example. If you chose 14:45 as your expiration time, the trade would close exactly at 14:45.

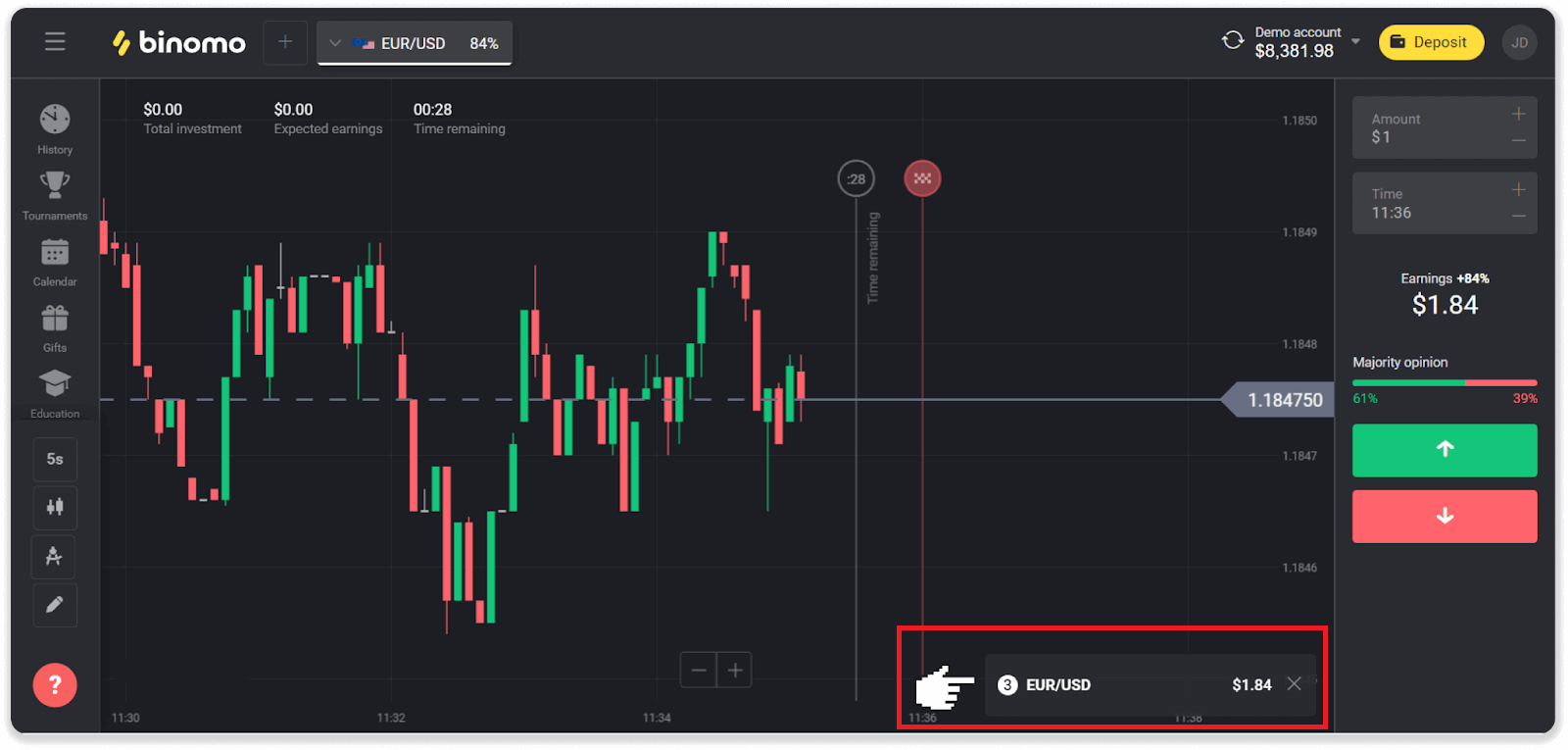

Also, there’s a line that shows the purchase time for your trade. You should pay attention to this line. It lets you know if you can open another trade. And the red line marks the end of the trade. At that time, you know the trade can get additional funds or can not get.

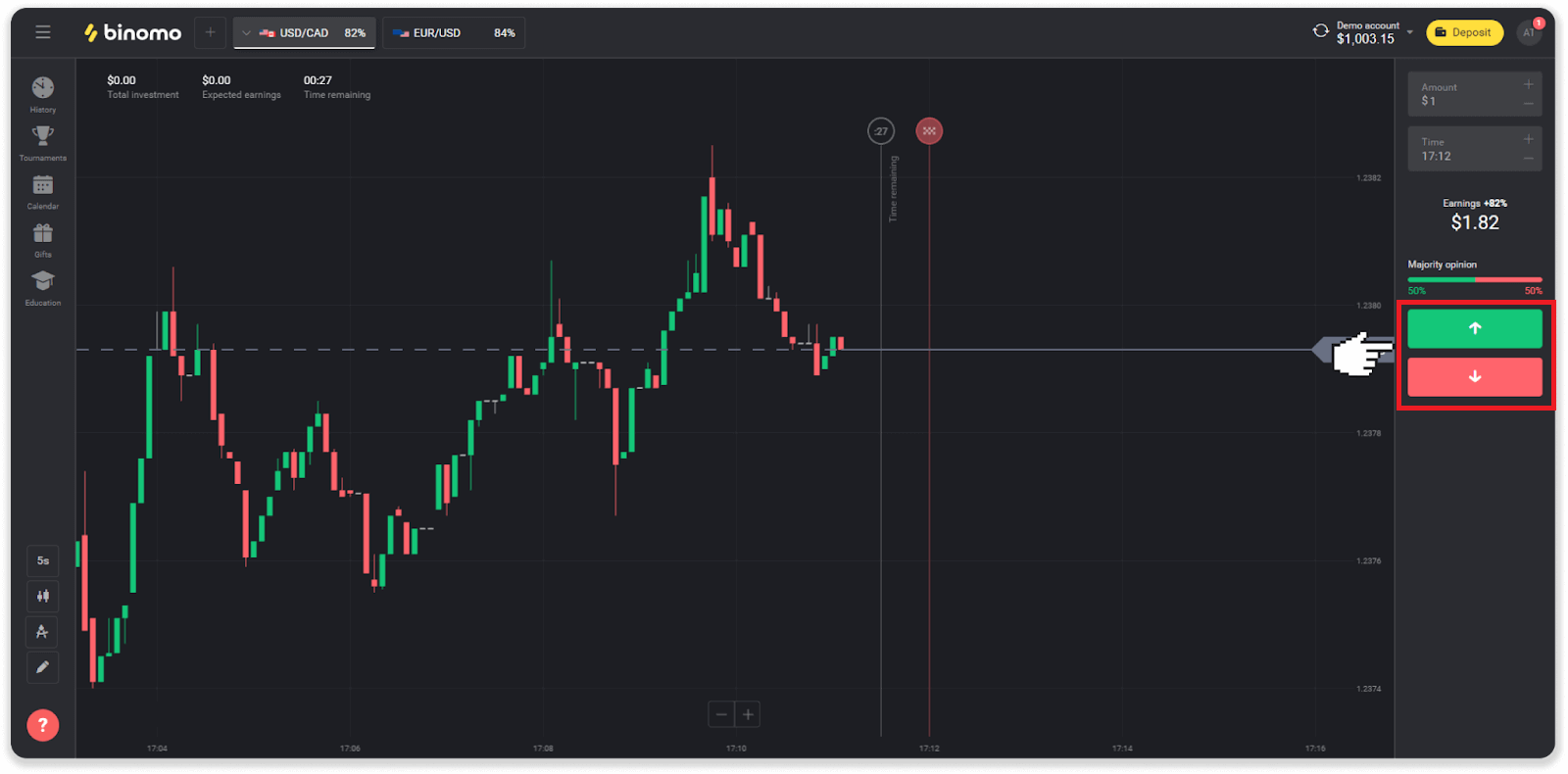

5. Analyze the price movement on the chart and make your forecast. Click on the green button if you think the price of an asset will go up, or the red button if you think it will go down.

6. Wait for the trade to close to find out whether your forecast was correct. If it was, the amount of your investment plus the profit from the asset would be added to your balance. In case of a tie – when the opening price equals the closing price – only the initial investment would be returned to your balance. If your forecast was incorrect – the investment would not be returned.

Note. The market is always closed on the weekend, so currency pairs, commodity assets, and company stocks are not available. Market assets will be available on Monday at 7:00 UTC. In the meantime, we offer trading on OTC - the weekend assets!

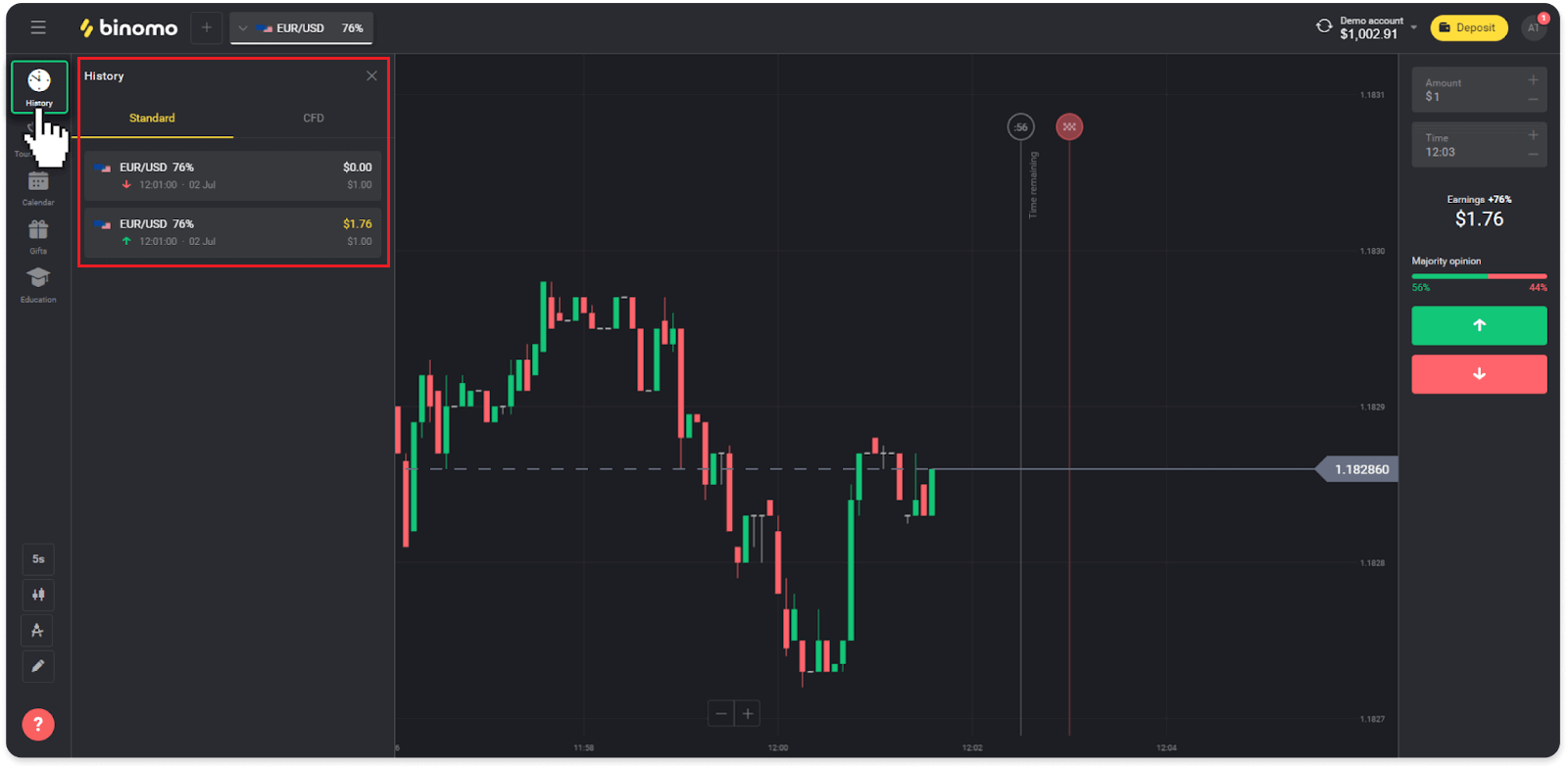

Where can I find the history of my trades with Binomo?

There is a history section, where you can find all the information about your open trades and trades you’ve concluded. To open your trade history, follow these steps:In the web version:

1. Click the “Clock” icon on the left side of the platform.

2. Click on any trade to see more information.

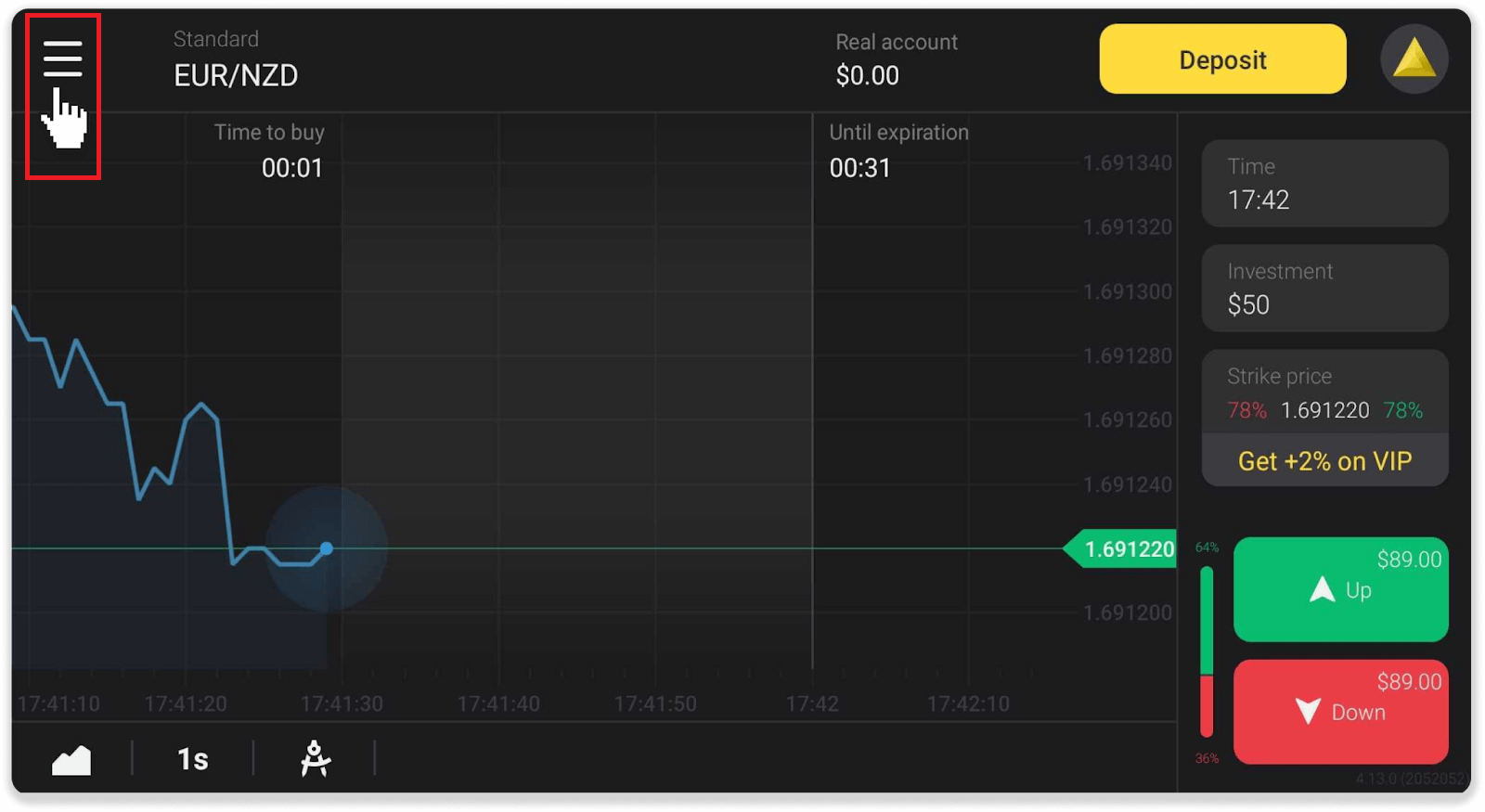

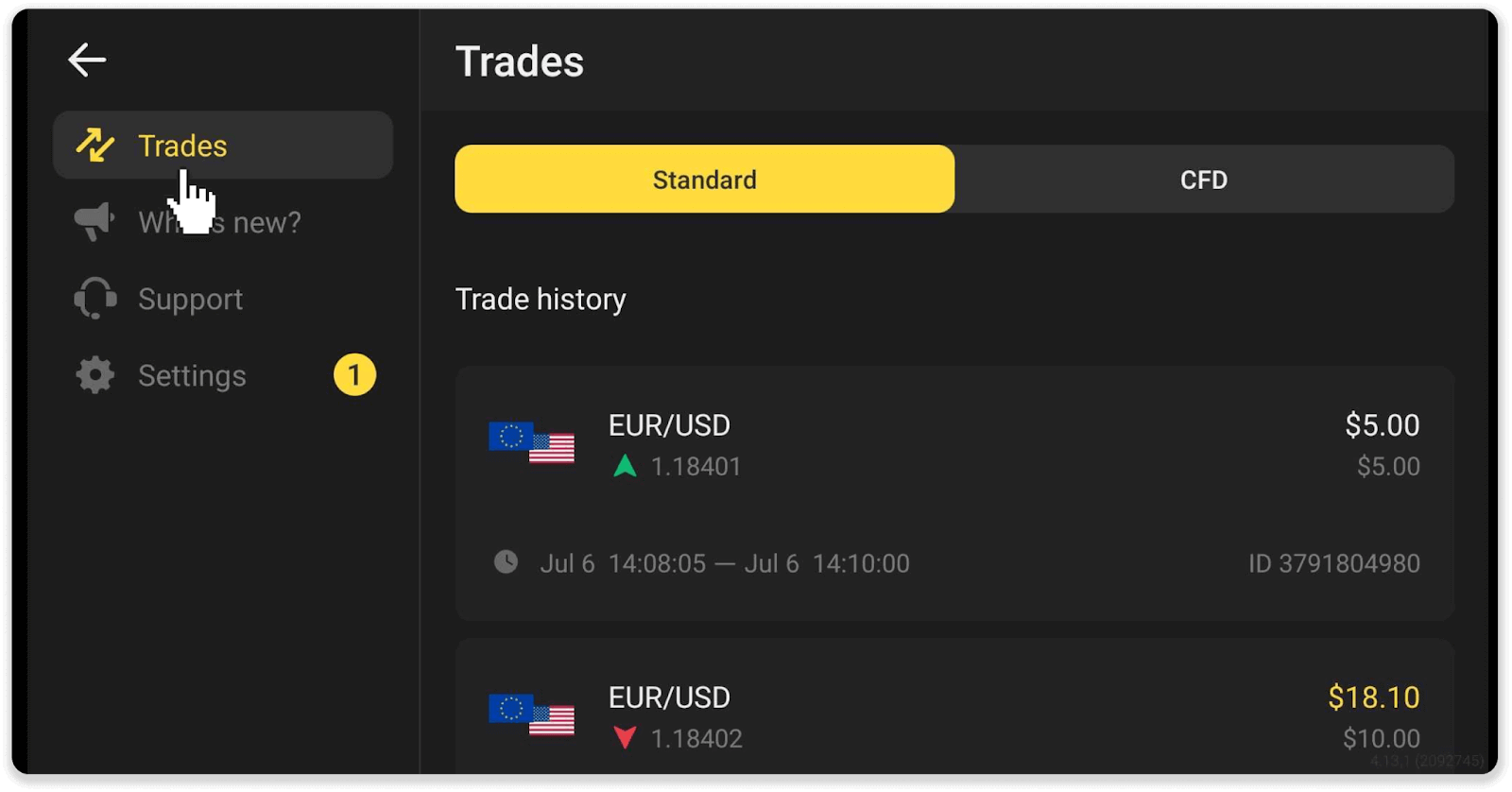

In the mobile app:

1. Open a menu.

2. Choose the “Trades” section.

Note. The trade history section can help you improve your trading skills by regularly analyzing your progress

How to calculate trading turnover?

Trading turnover is the sum of all trades since the last deposit.There are two cases when trading turnover is used:

- You made a deposit and decided to withdraw funds before trading.

- You used a bonus that implies a trading turnover.

Example. A trader deposited $50. The amount of trading turnover for the trader will be $100 (double the deposit amount). When trading turnover is completed, a trader can withdraw funds without commission.

In the second case, when you activate a bonus, you have to complete trading turnover to withdraw funds.

Trading turnover is calculated by this formula:

the amount of the bonus multiplied by its leverage factor.

A leverage factor can be:

- Specified in the bonus.

- If it’s not specified, then for bonuses that are less than 50% of the deposit amount, the leverage factor would be 35.

- For the bonuses that are more than 50% of the deposit, it would be 40.

Note. Both successful and unsuccessful trades count for trading turnover, but only the asset’s profitability is taken into account; investment is not included.

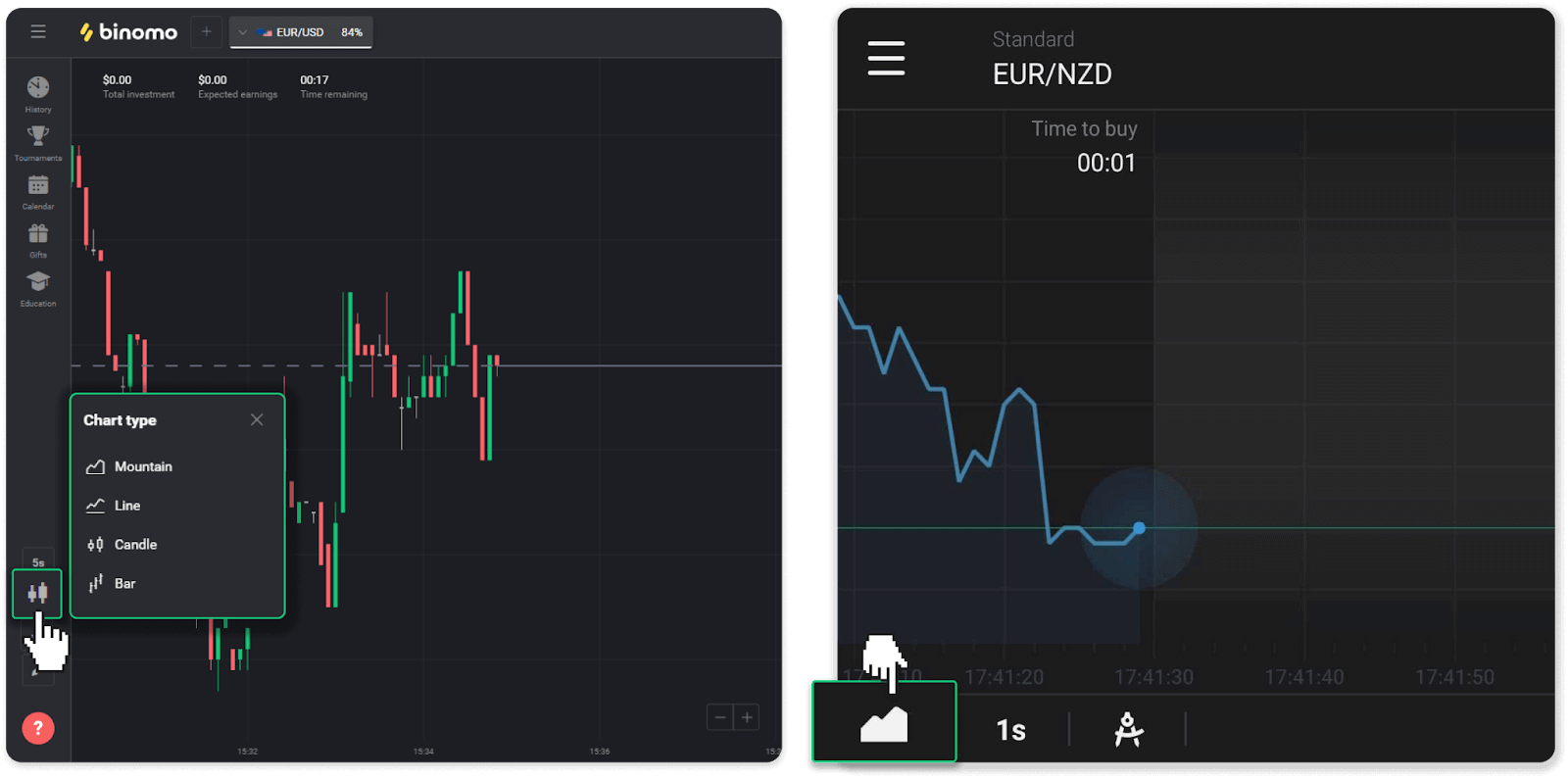

How to read a chart with Binomo?

The chart is the trader’s main tool on the platform. A chart displays the price dynamic of a chosen asset in real-time.You can adjust the chart according to your preferences.

1. To choose a chart type, click on the chart icon in the lower-left corner of the platform. There are 4 chart types: Mountain, Line, Candle, and Bar.

Note. Traders prefer the Candle chart because it’s the most informative and useful.

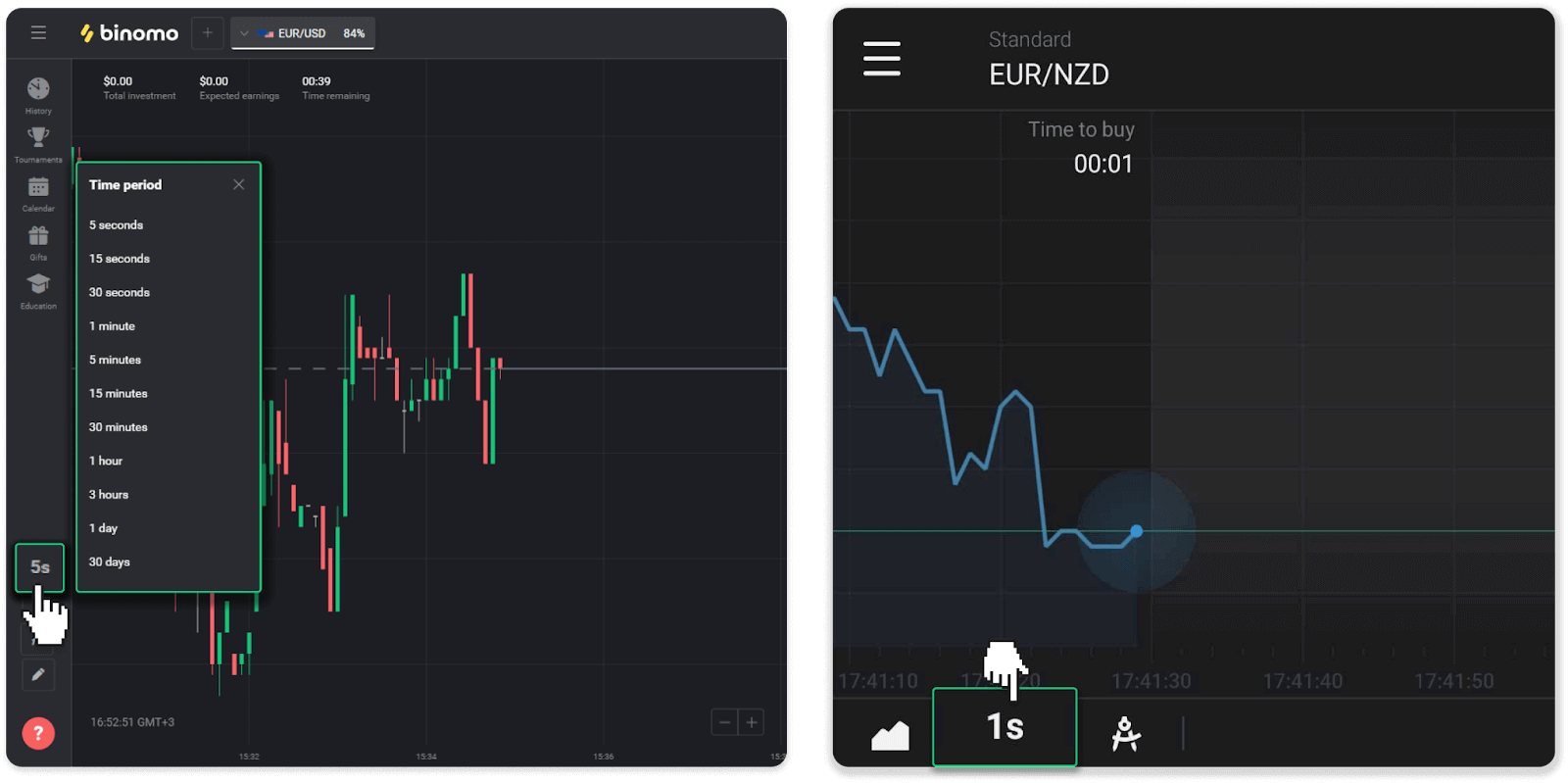

2. To choose a time period, click on a time icon. It determines how often the new price changes in the asset are displayed.

3. To zoom in and out on a chart, press the “+” and “-” buttons or scroll the mouse. Mobile app users can zoom in and out on a chart with their fingers.

4. To see older price changes drag the chart with your mouse or finger (for mobile app users).

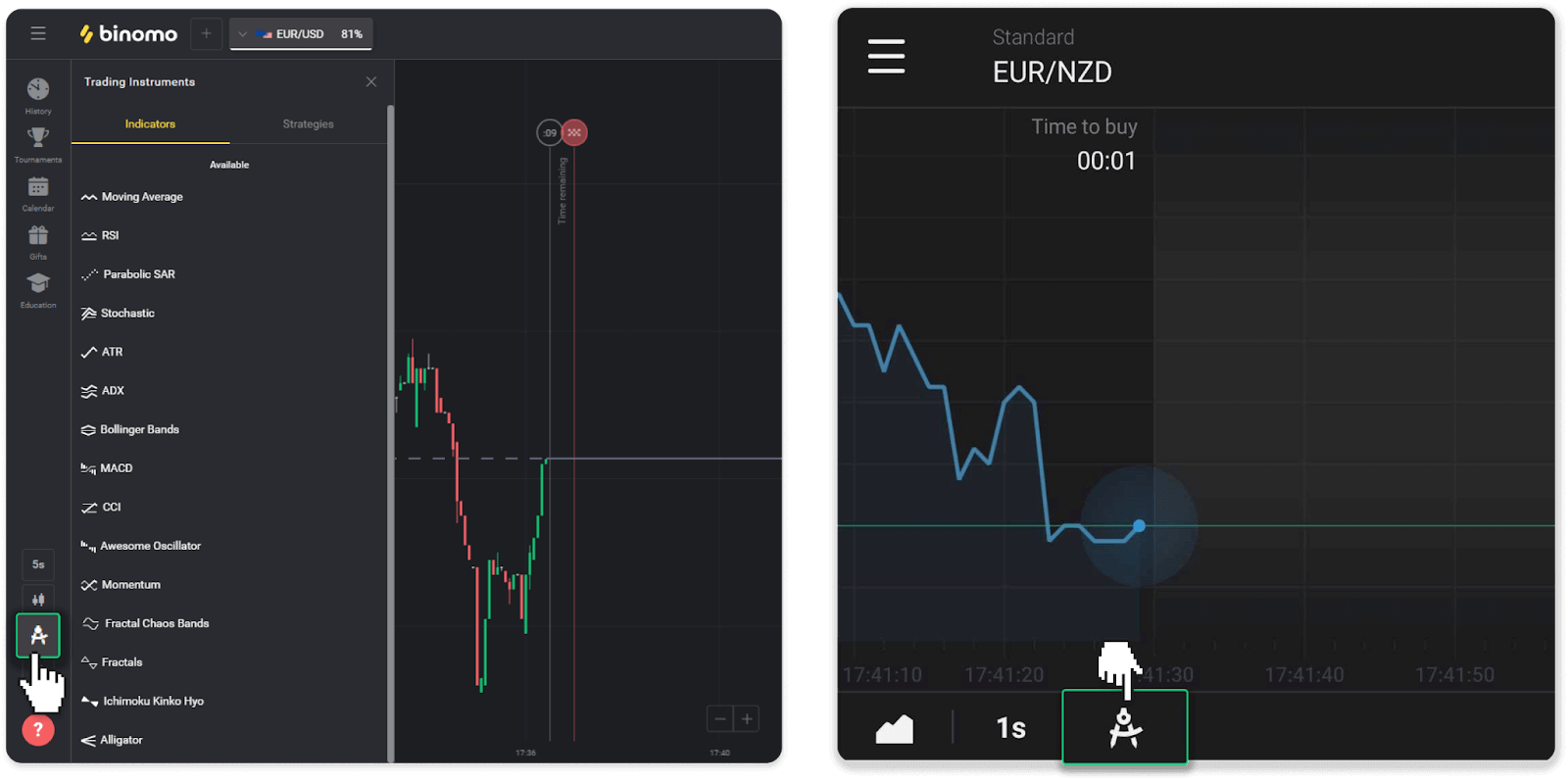

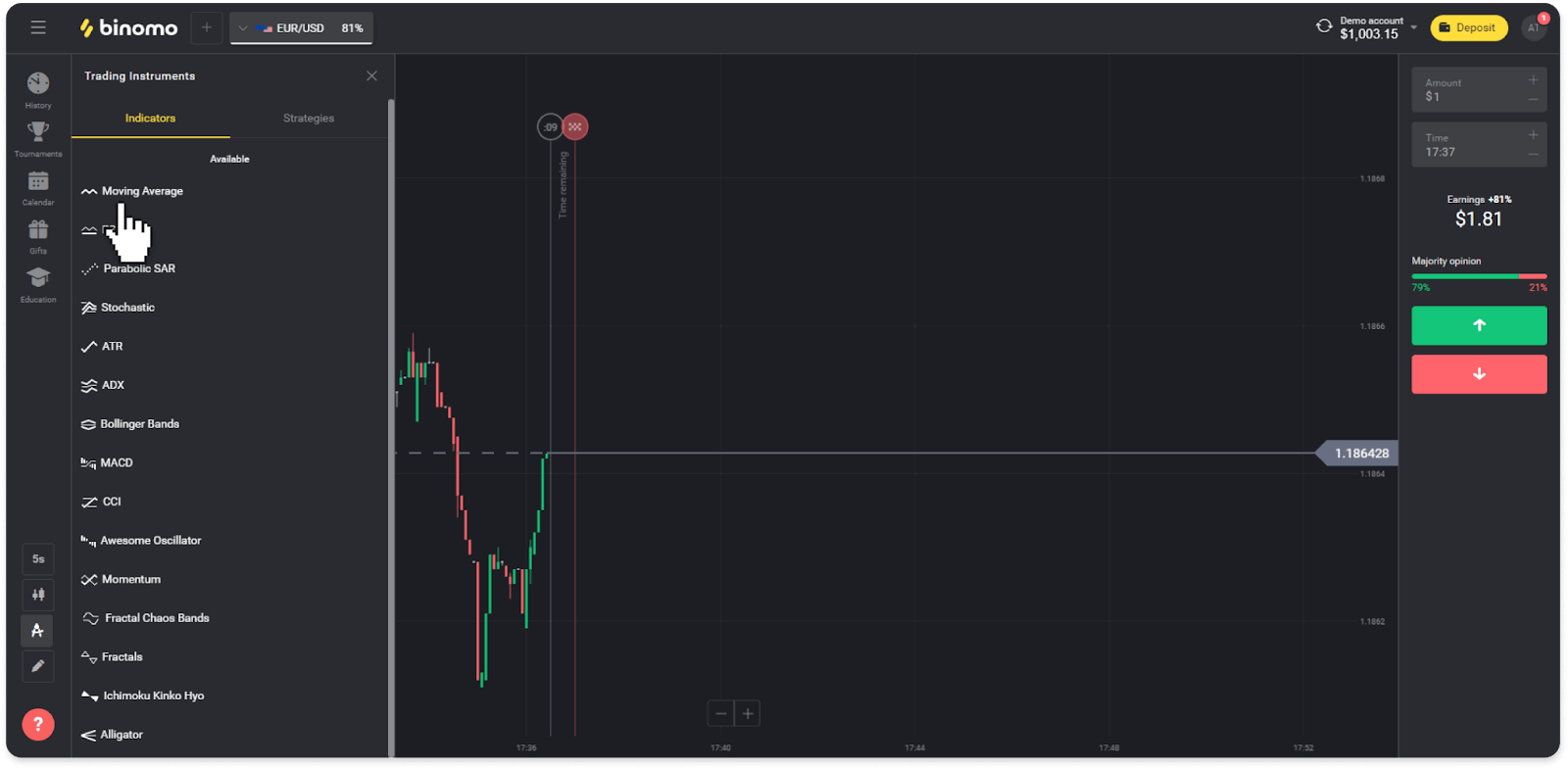

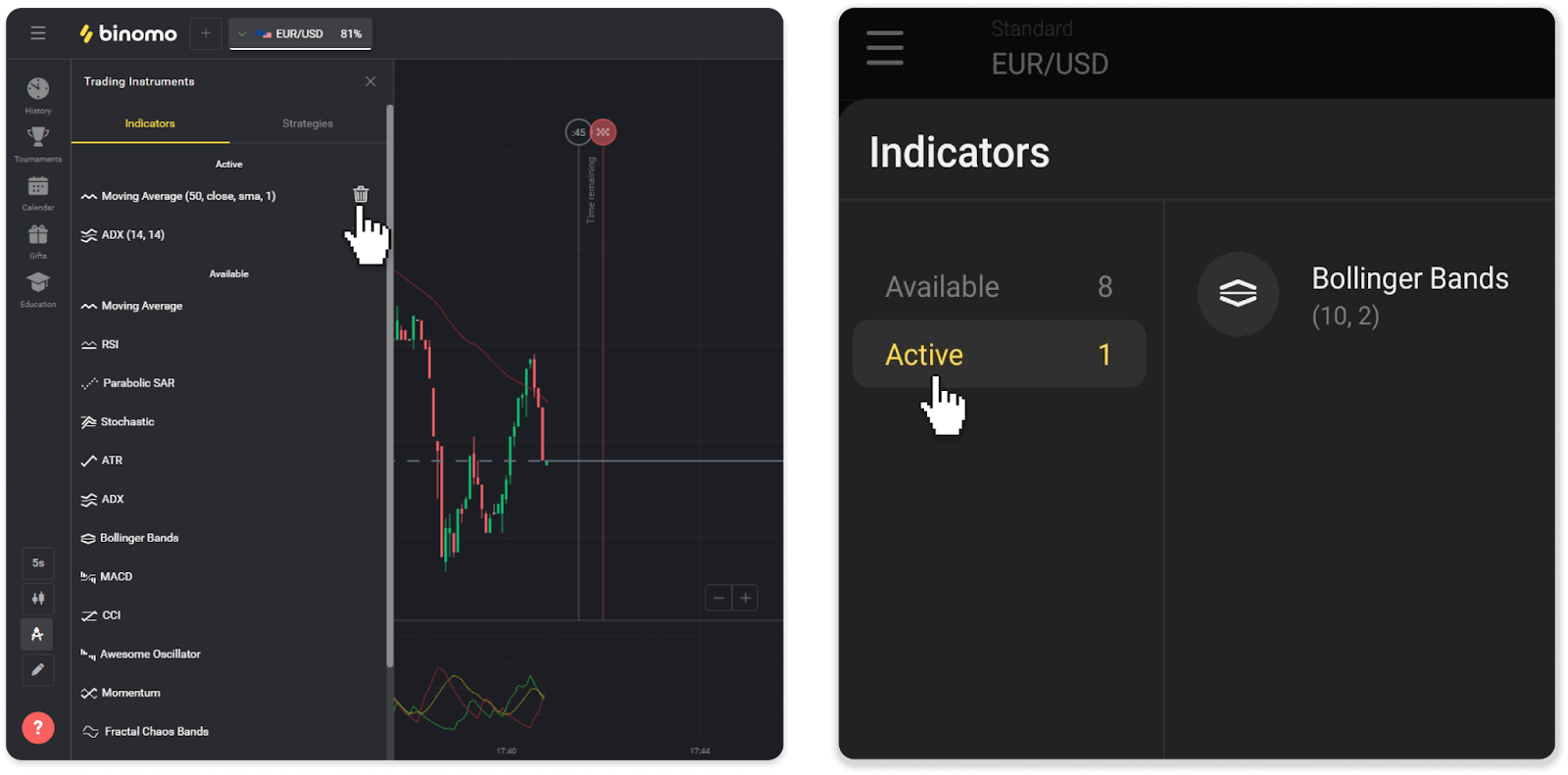

How to use indicators with Binomo?

Indicators are visual tools that help track changes in price movements. Traders use them to analyze the chart and conclude more successful trades. Indicators go alongside different trading strategies.You can adjust indicators in the bottom left corner of the platform.

1. Click on the “Trading instruments” icon.

2. Activate the indicator you need by clicking on it.

3. Adjust it the way you want and press “Apply”.

4. All active indicators will appear above the list. To remove active indicators, press the trash bin icon. Mobile app users can find all active indicators on the “Indicators” tab.

Frequently Asked Questions (FAQ)

Can I close a trade before expiration time?

When you trade with the Fixed Time Trades mechanics, you choose the exact time the trade will be closed, and it cannot be closed earlier.However, if you’re using CFD mechanics, you can close a trade before the expiration time. Please note that this mechanics is only available on the demo account.

How to switch from a demo to a real account?

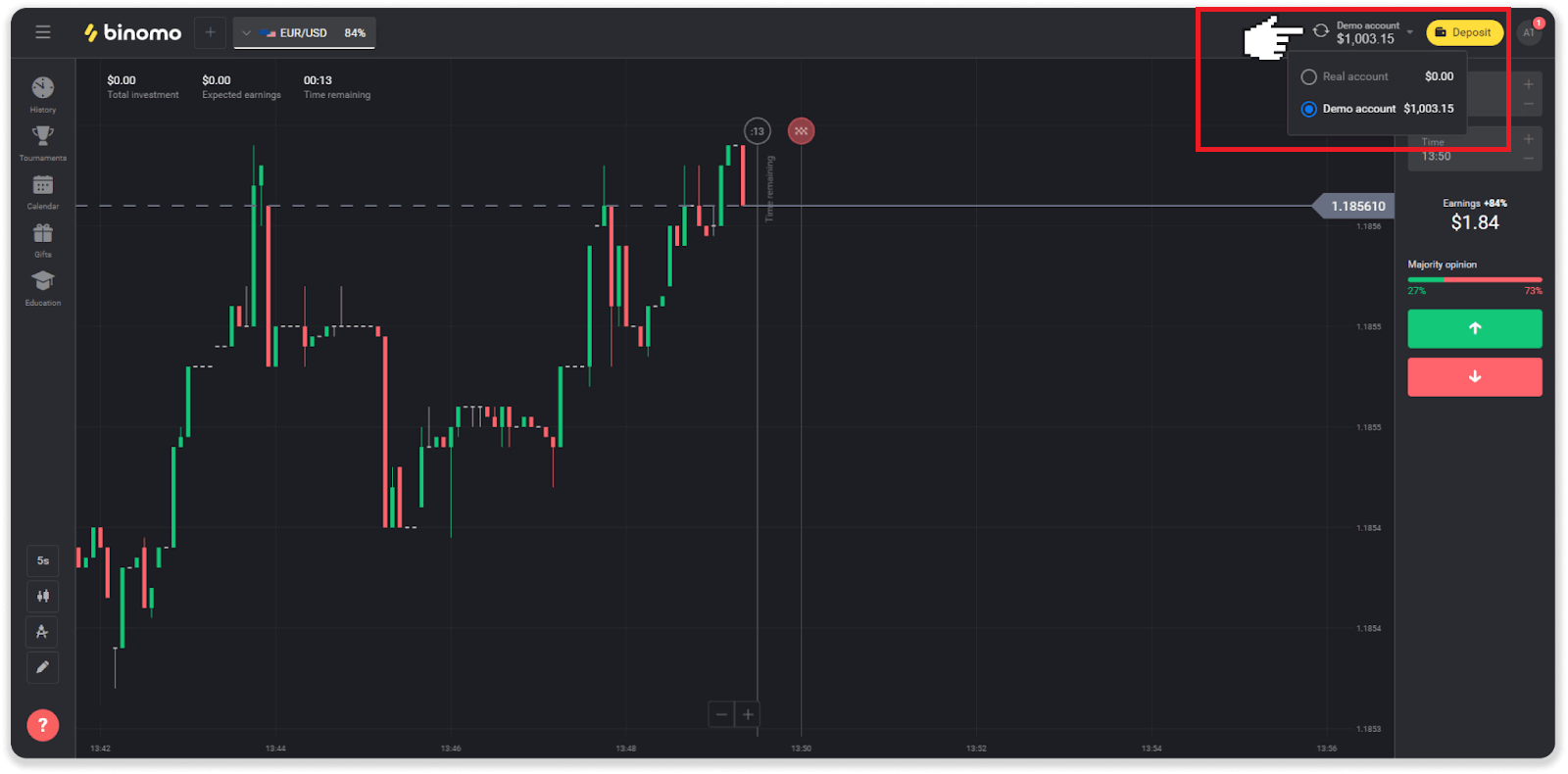

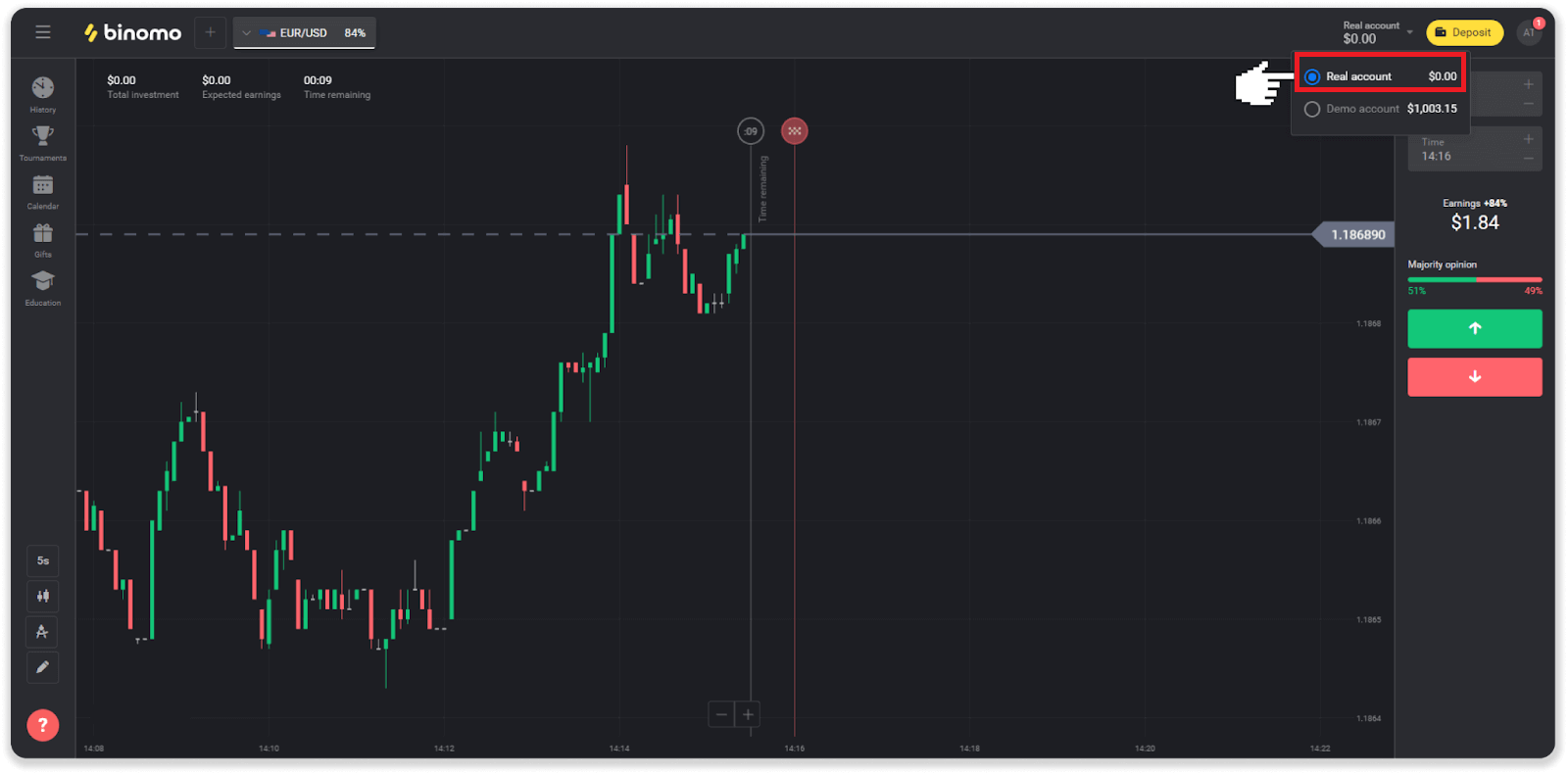

To switch between your accounts, follow these steps:1. Click on your account type in the top corner of the platform.

2. Choose “Real account”.

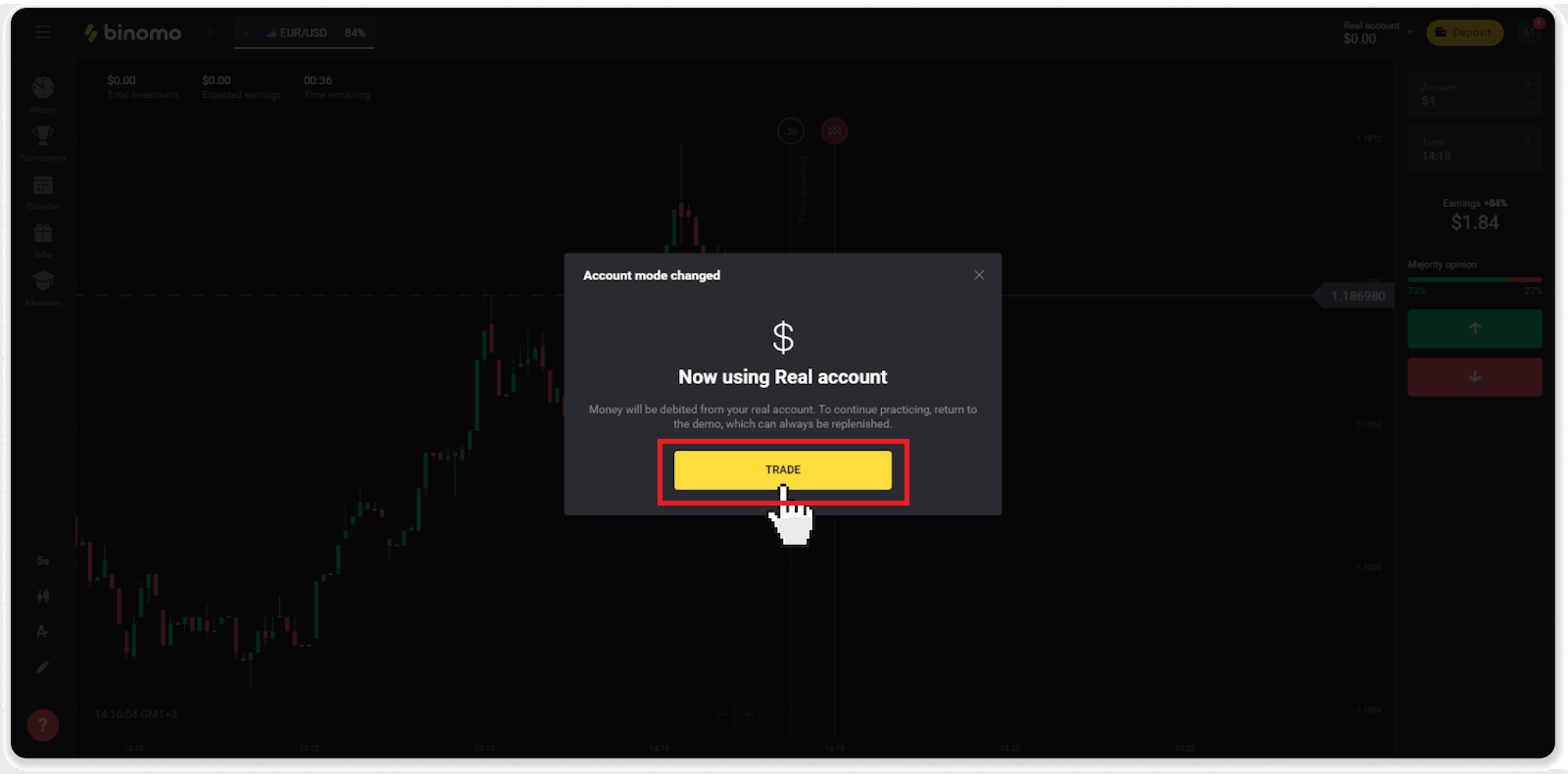

3. The platform will notify you that you are now using real funds. Click “Trade”.

How to be efficient in trading?

The main goal of trading is to correctly forecast the movement of an asset to get additional profit.Every trader has their own strategy and a set of tools to make their forecasts more precise.

Here are a few key points to a pleasant start in trading:

- Use the demo account to explore the platform. A demo account allows you to try out new assets, strategies, and indicators without financial risks. It’s always a good idea to come into trading prepared.

- Open your first trades with small amounts, for example, $1 or $2. It will help you test the market and gain confidence.

- Use familiar assets. This way, it will be easier for you to predict the changes. For example, you can start with the most popular asset on the platform – EUR/USD pair.

- Don’t forget to explore new strategies, mechanics, and techniques! Learning is trader’s best tool.

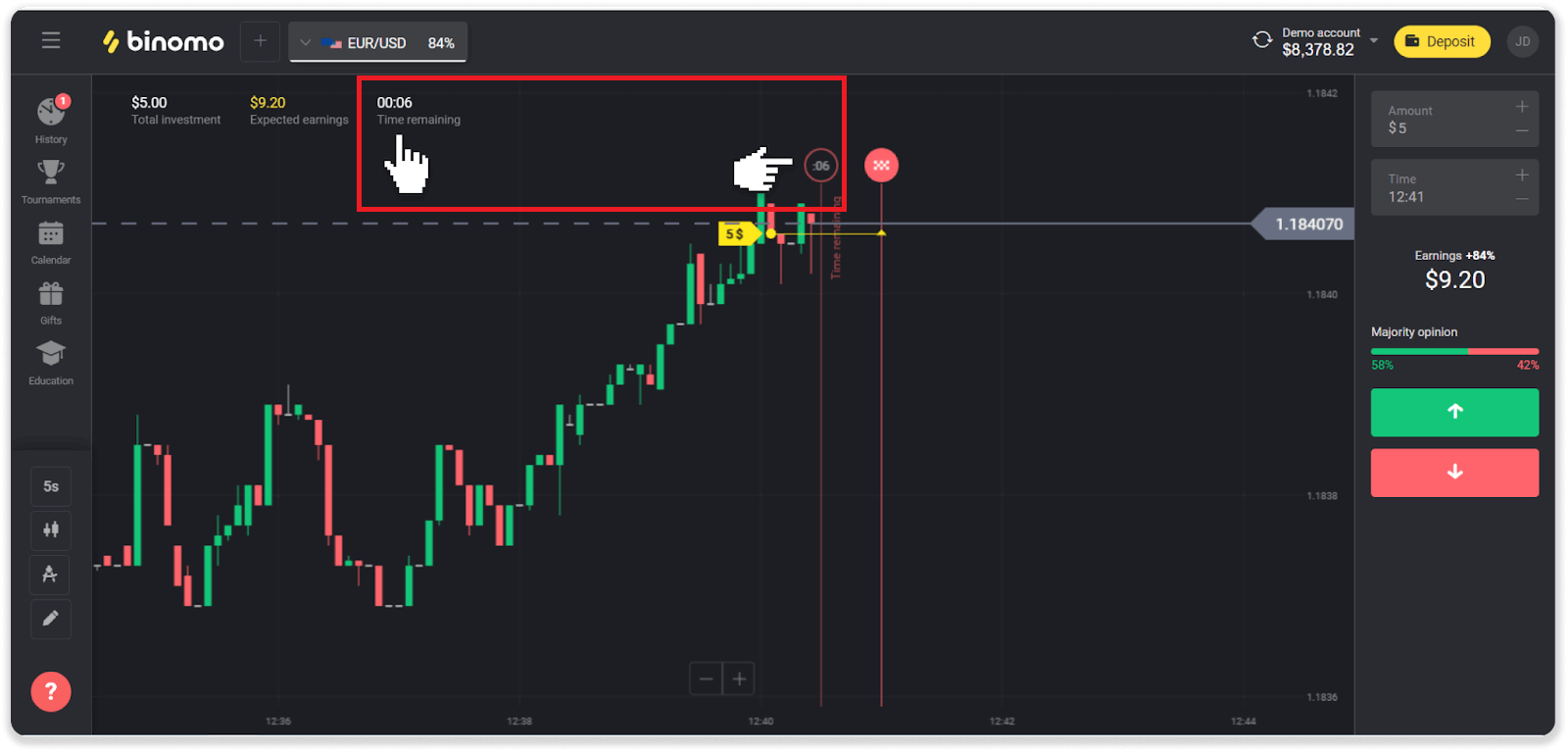

What does time remaining mean?

The time remaining (time to buy for mobile app users) shows how much time there is left to open a trade with selected expiration time. You can see the remaining time above the chart (on the web version of the platform), and it’s also indicated by a red vertical line on the chart.

If you change the expiration time (the time the trade ends), the time remaining will also change.

Why are some assets not available to me?

There are two reasons why certain assets are not available to you:- The asset is only available to traders with an account status Standard, Gold, or VIP.

- The asset is only available on certain days of the week.

Note. The availability depends on the day of the week and may also change throughout the day.

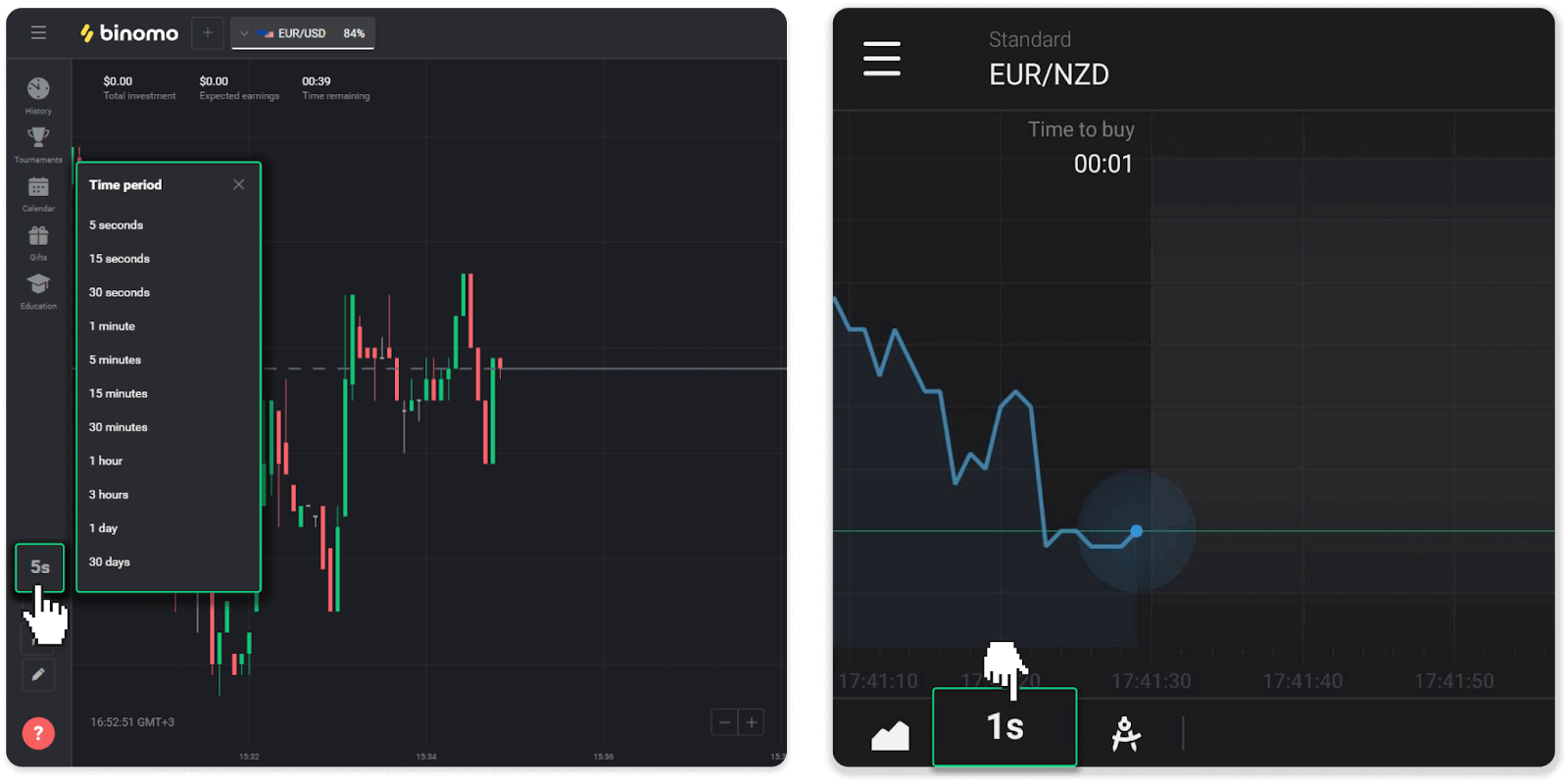

What is a time period?

A time period, or a time frame, is a period during which the chart is formed.You can change the time period by clicking on the icon in the lower-left corner of the chart.

The time periods are different for chart types:

- For the “Candle” and “Bar” charts, the minimum period is 5 seconds, the maximum – 30 days. It displays the period during which 1 candle or 1 bar is formed.

- For the “Mountain” and “Line” charts – the minimum period is 1 second, the maximum is 30 days. The time period for these charts determines the frequency of displaying the new price changes.

Ways to withdraw funds from Binomo

Withdraw funds from Binomo with a Bank Account

Withdrawal of your Binomo trading account is made convenient with bank transfers, with no commission fees on transactions with this payment method.Bank account withdrawals are only available for banks of India, Indonesia, Turkey, Vietnam, South Africa, Mexico, and Pakistan.

Please note!

- Funds can be cashed out from Real account only;

- While you have a multiplied trading turnover you can’t withdraw your funds as well.

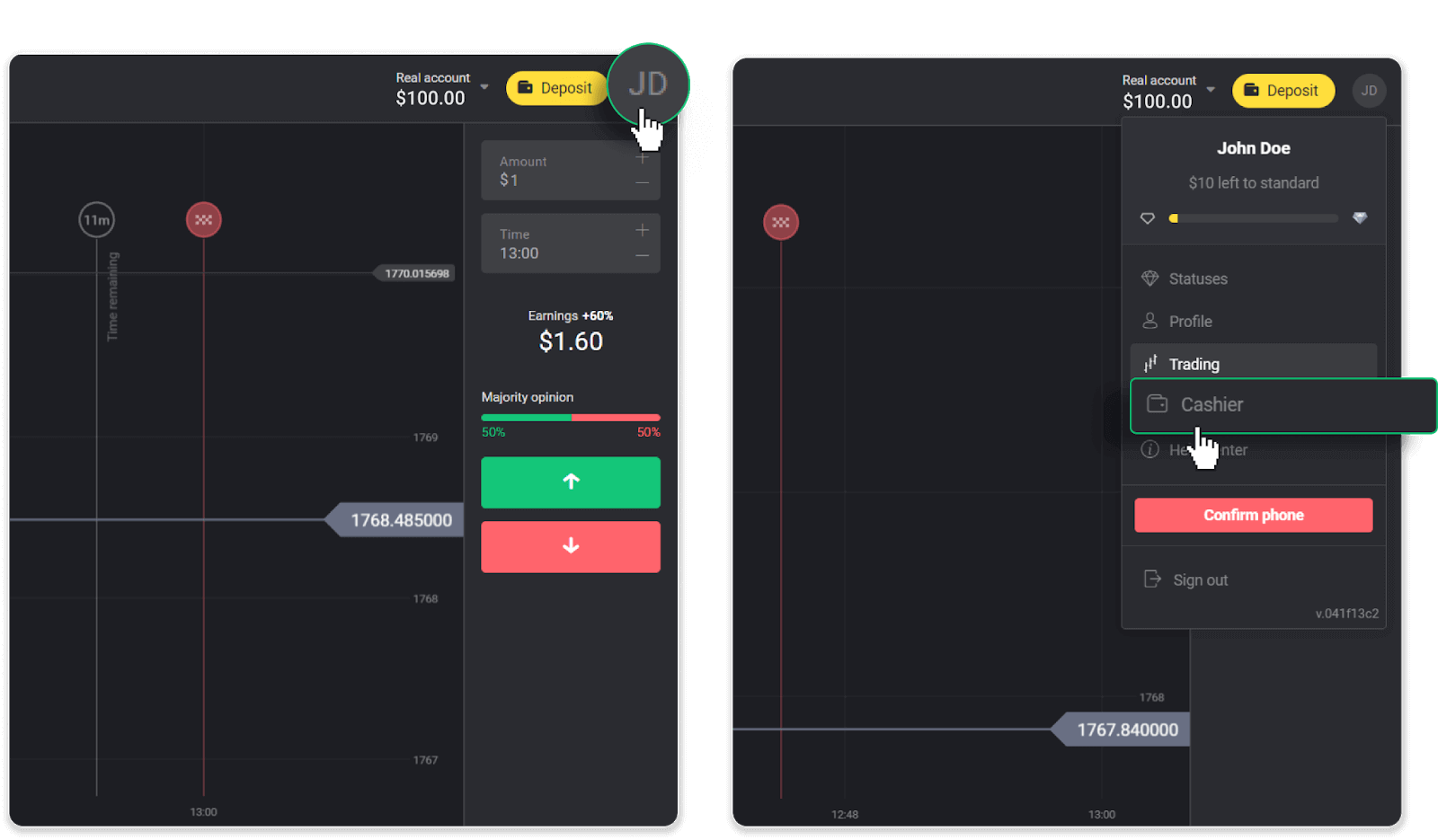

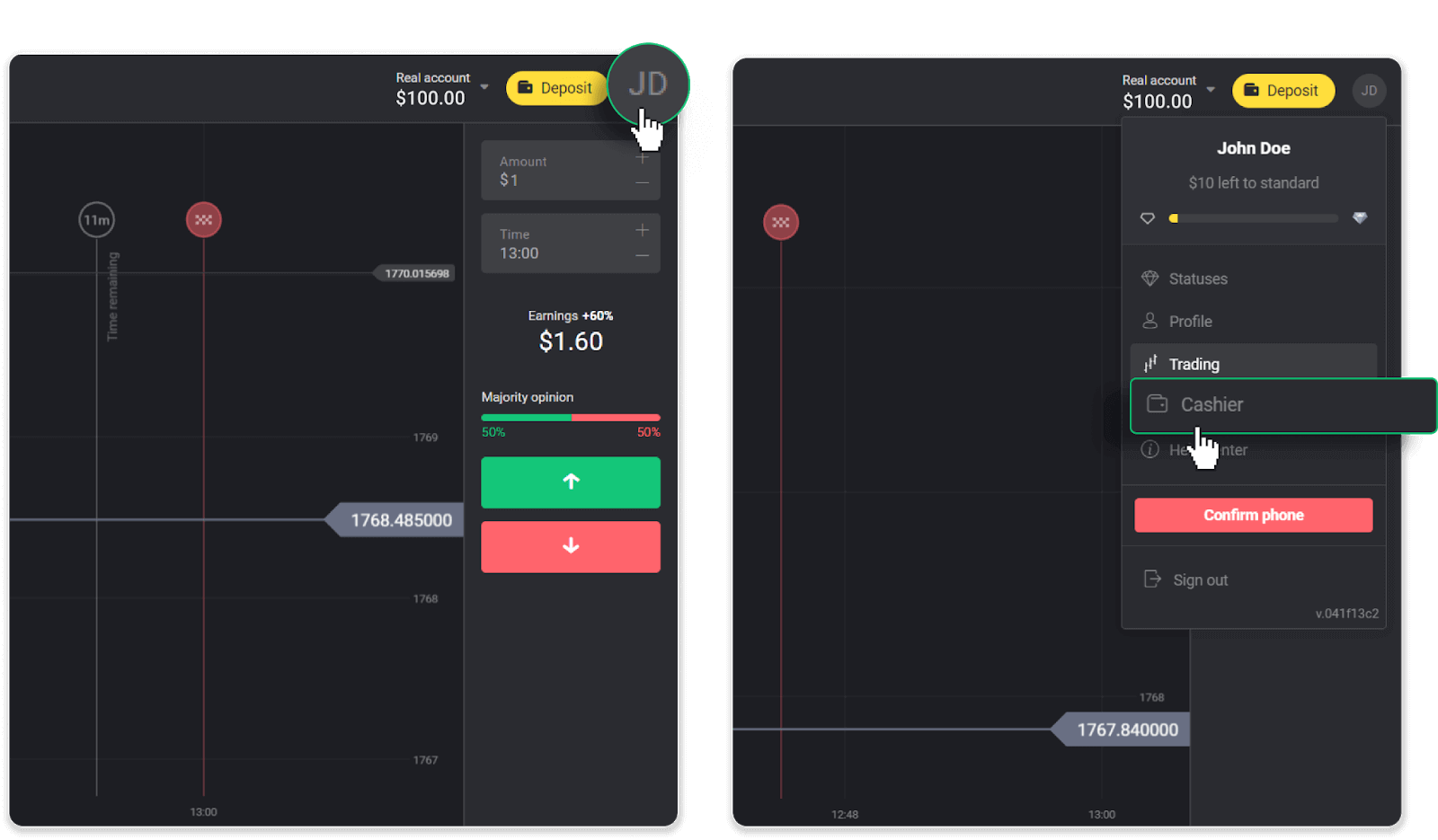

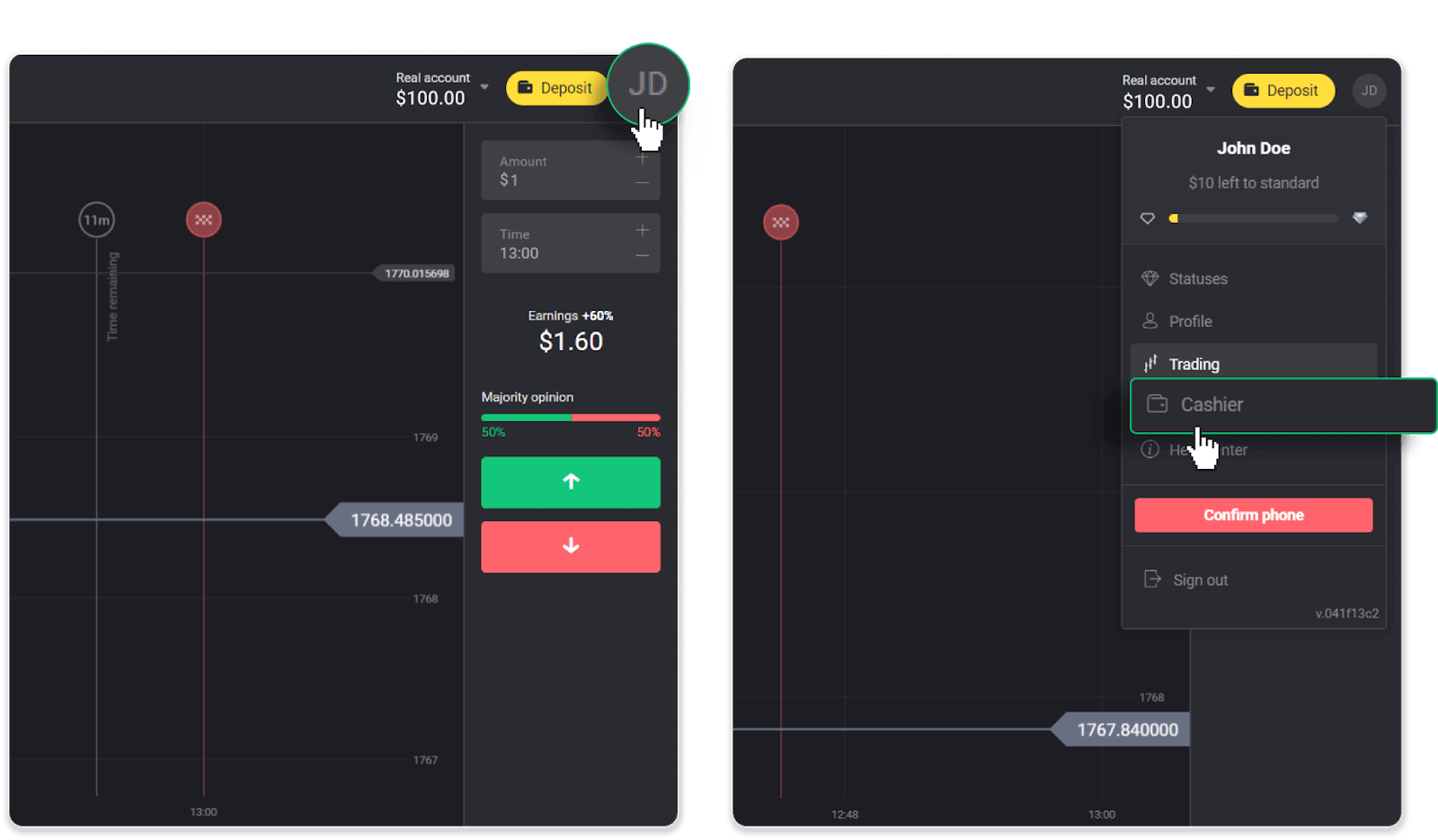

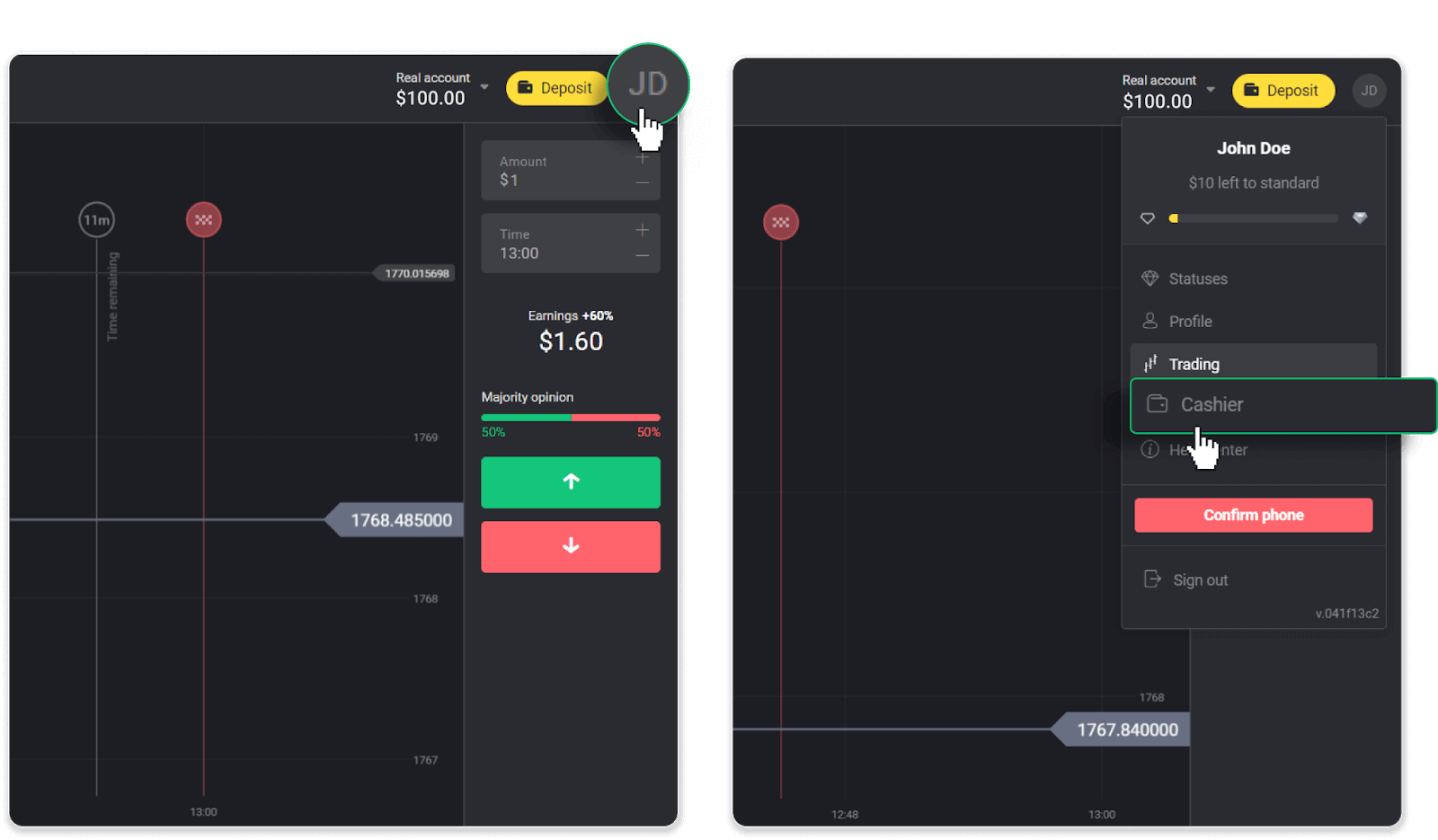

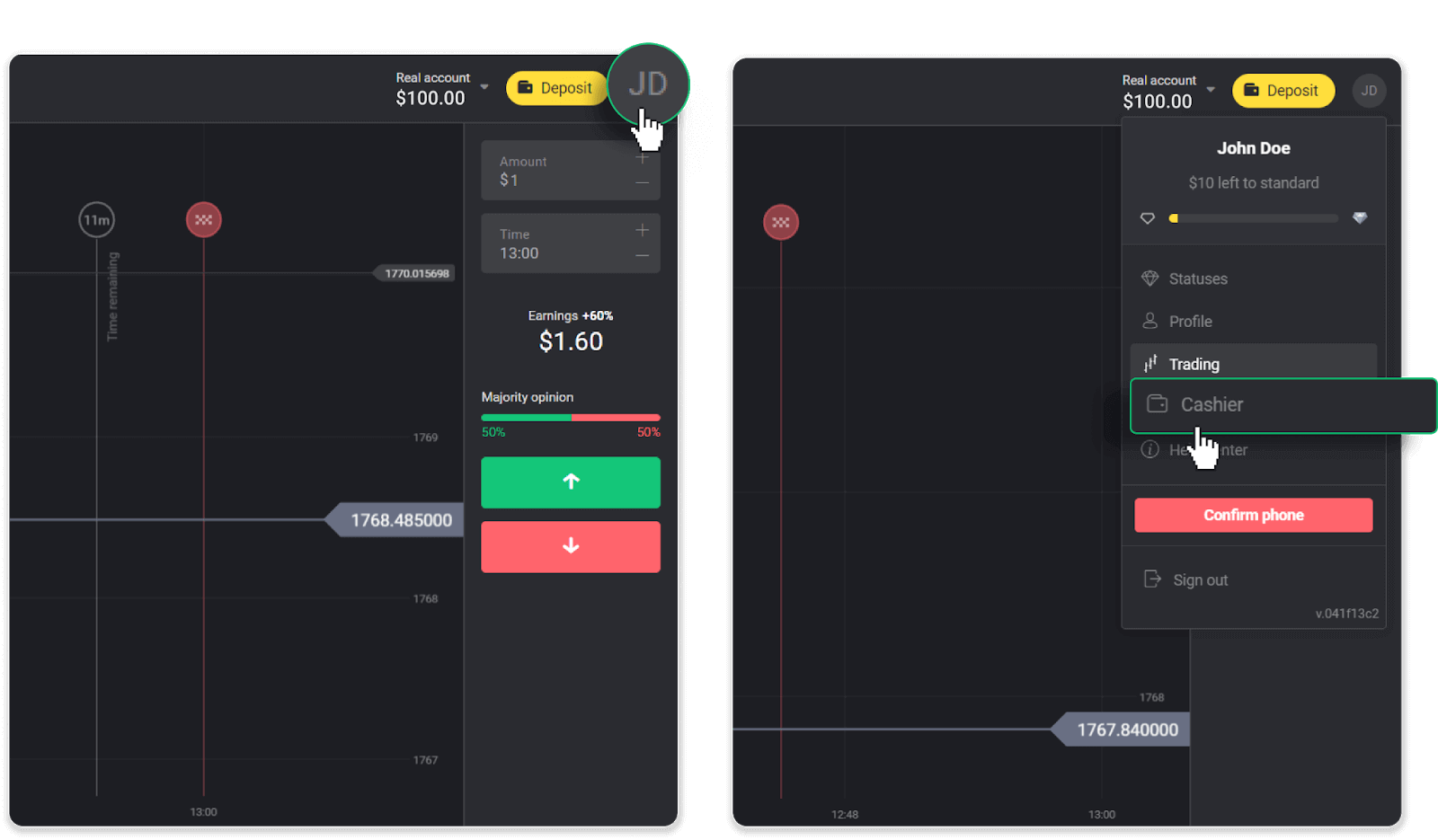

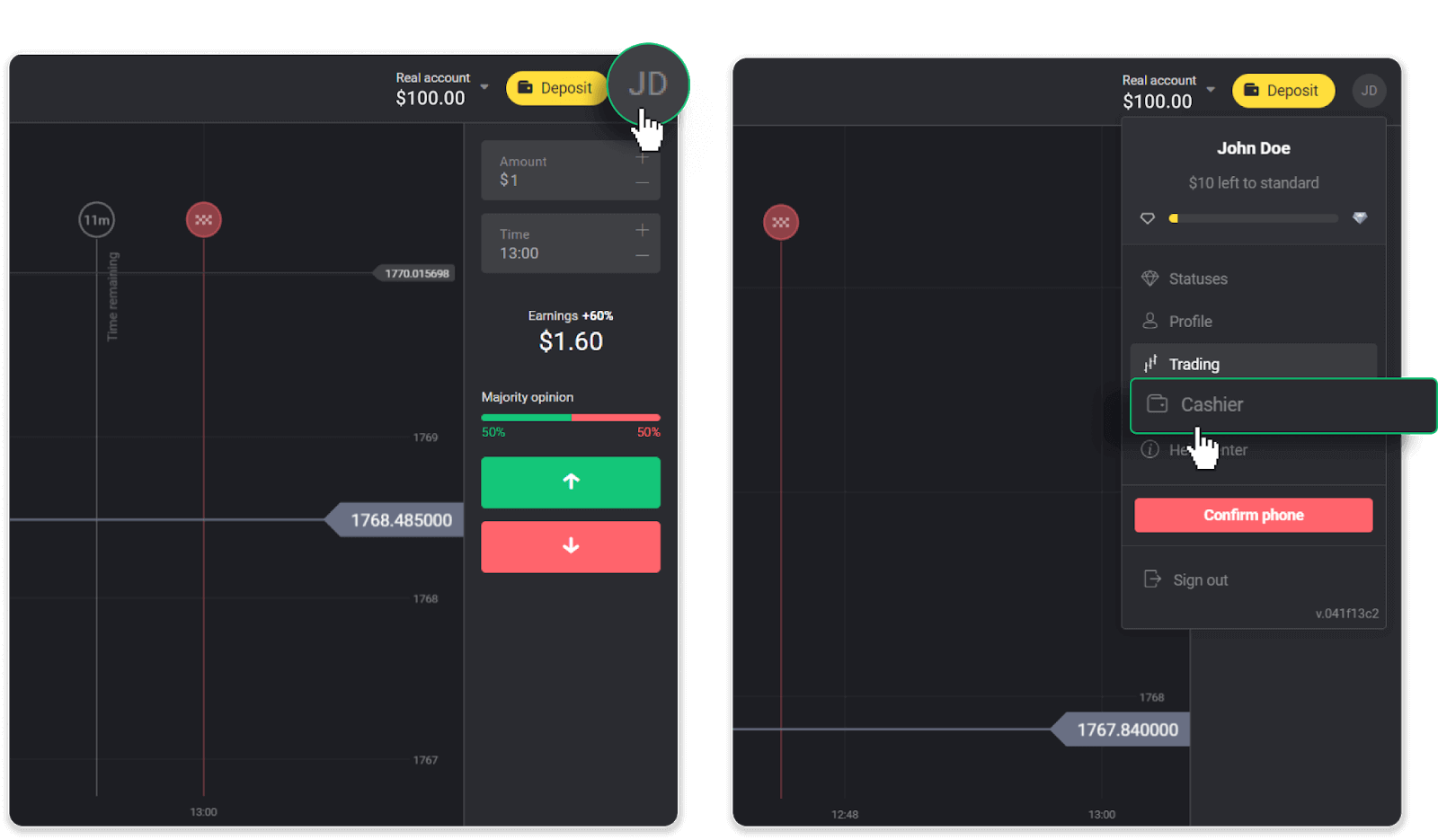

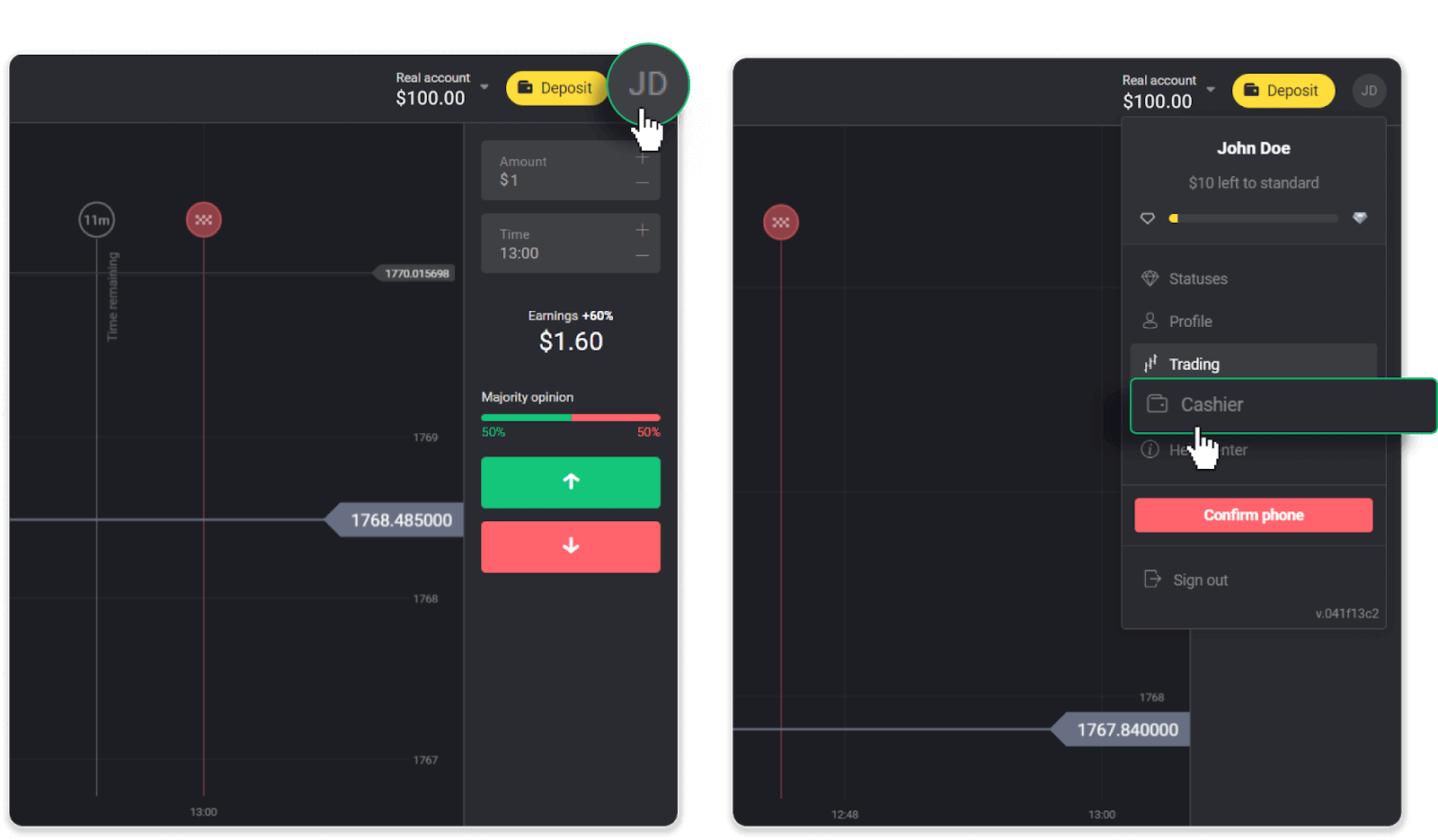

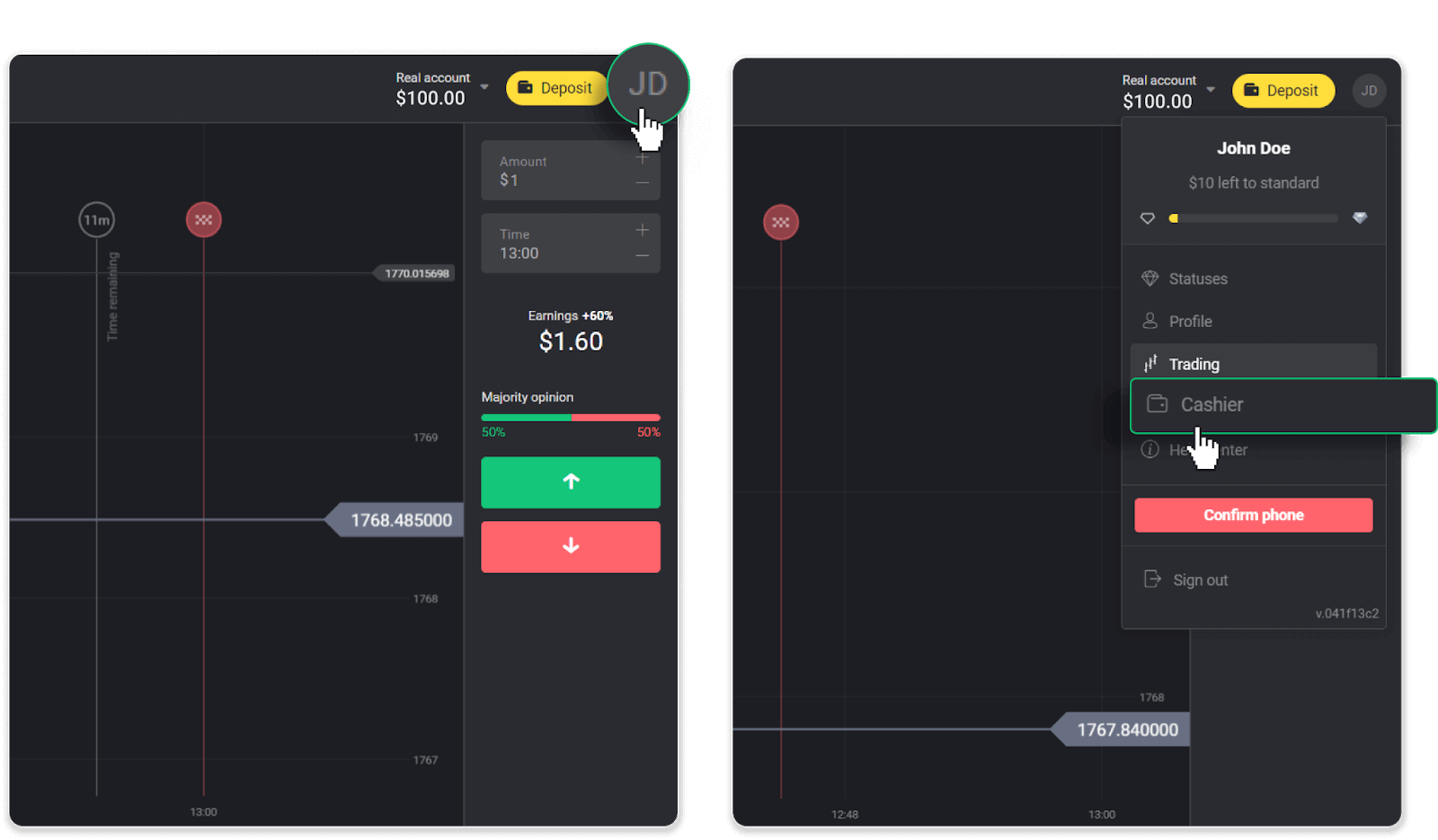

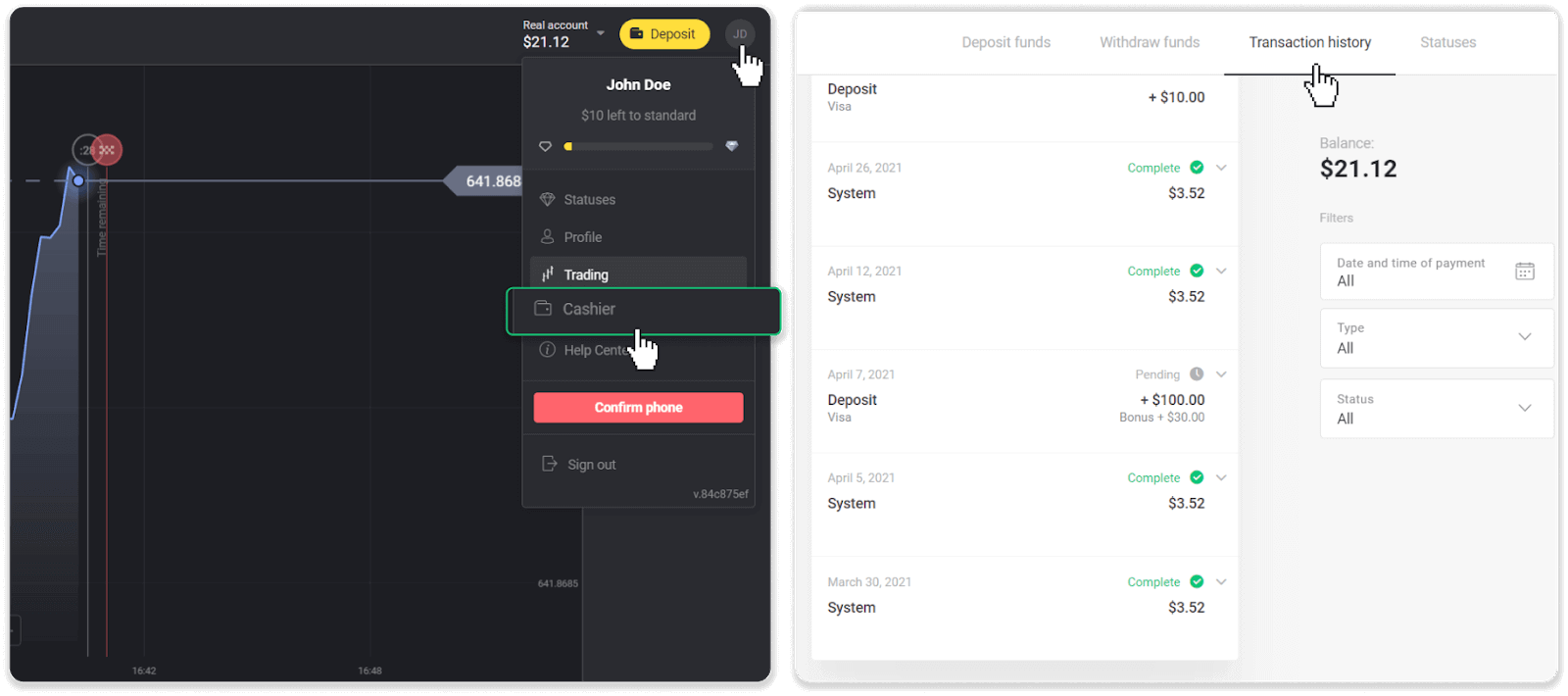

1. Go to the withdrawal in the “Cashier” section.

In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

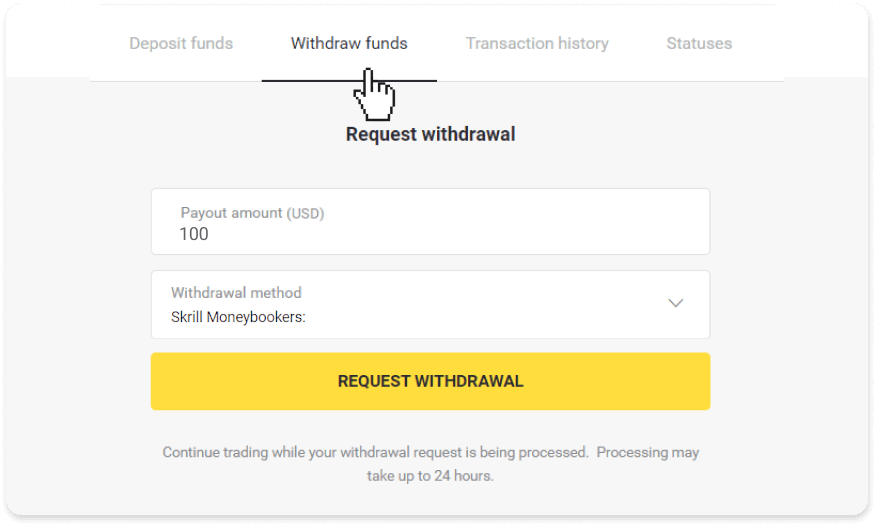

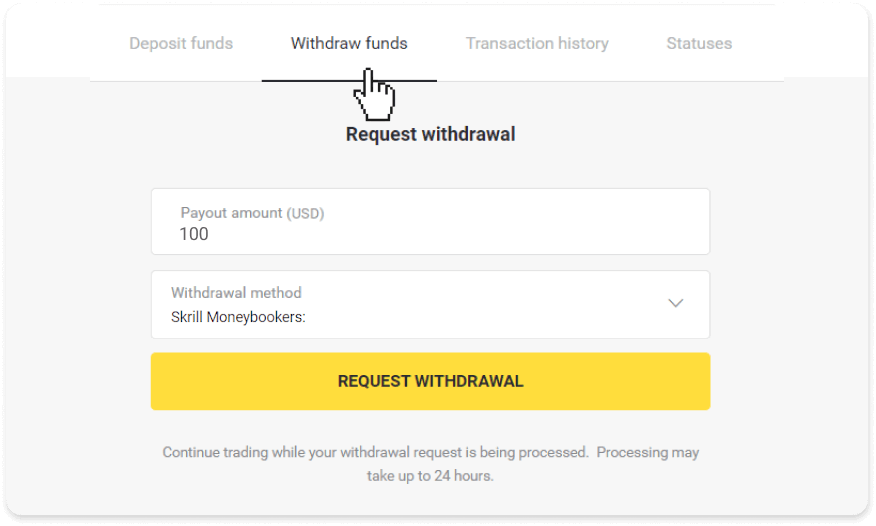

Then click the “Withdraw funds” tab.

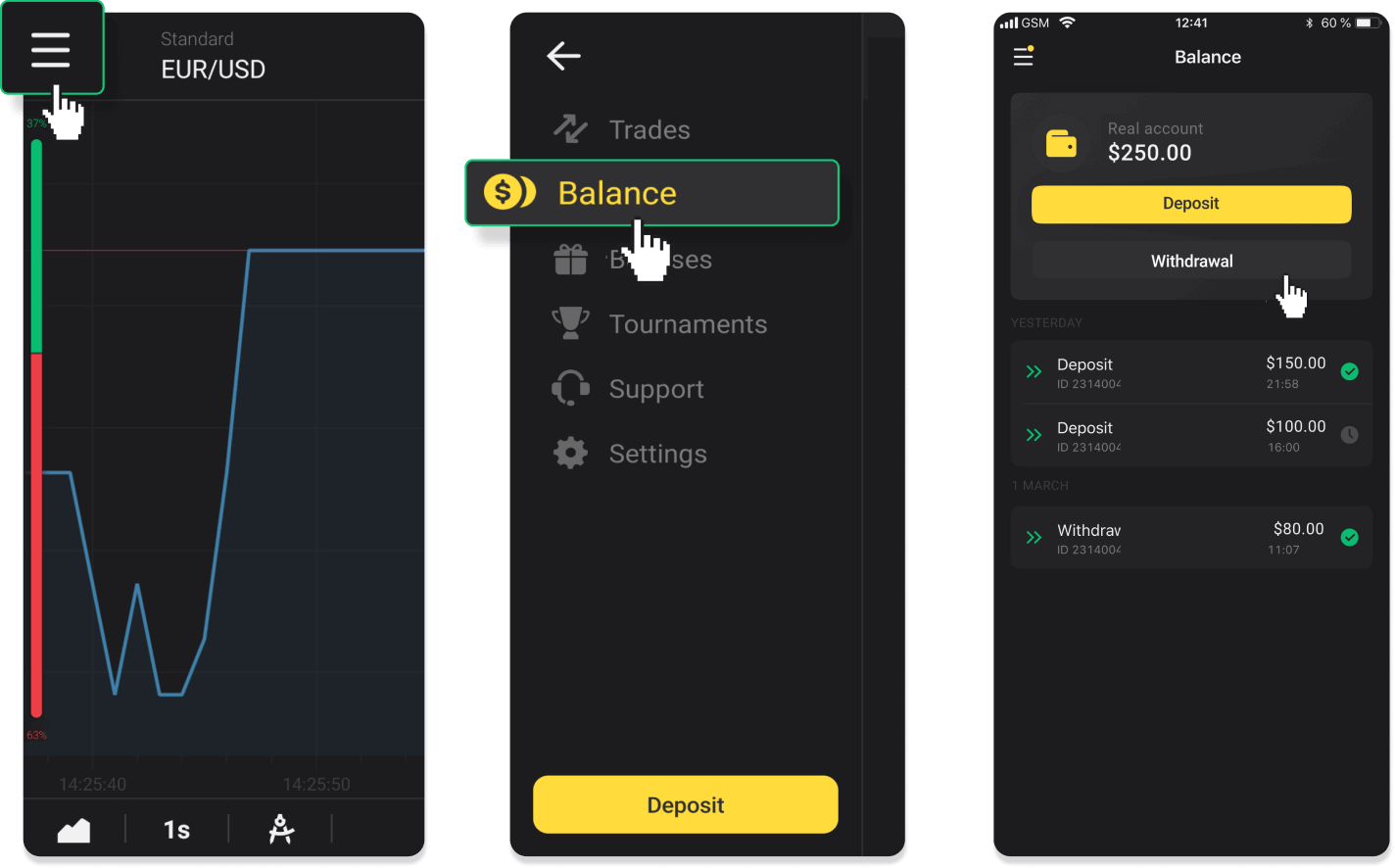

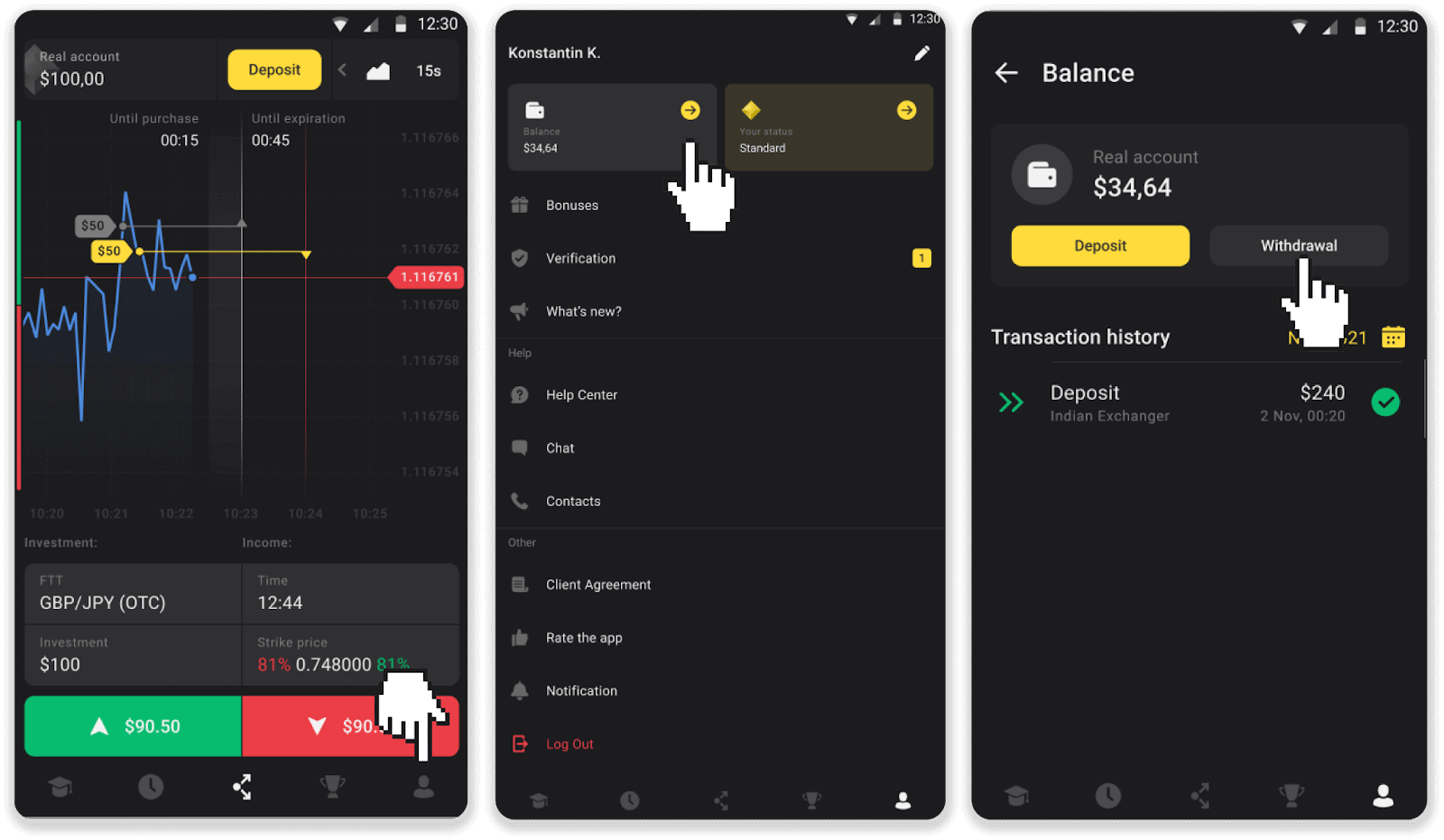

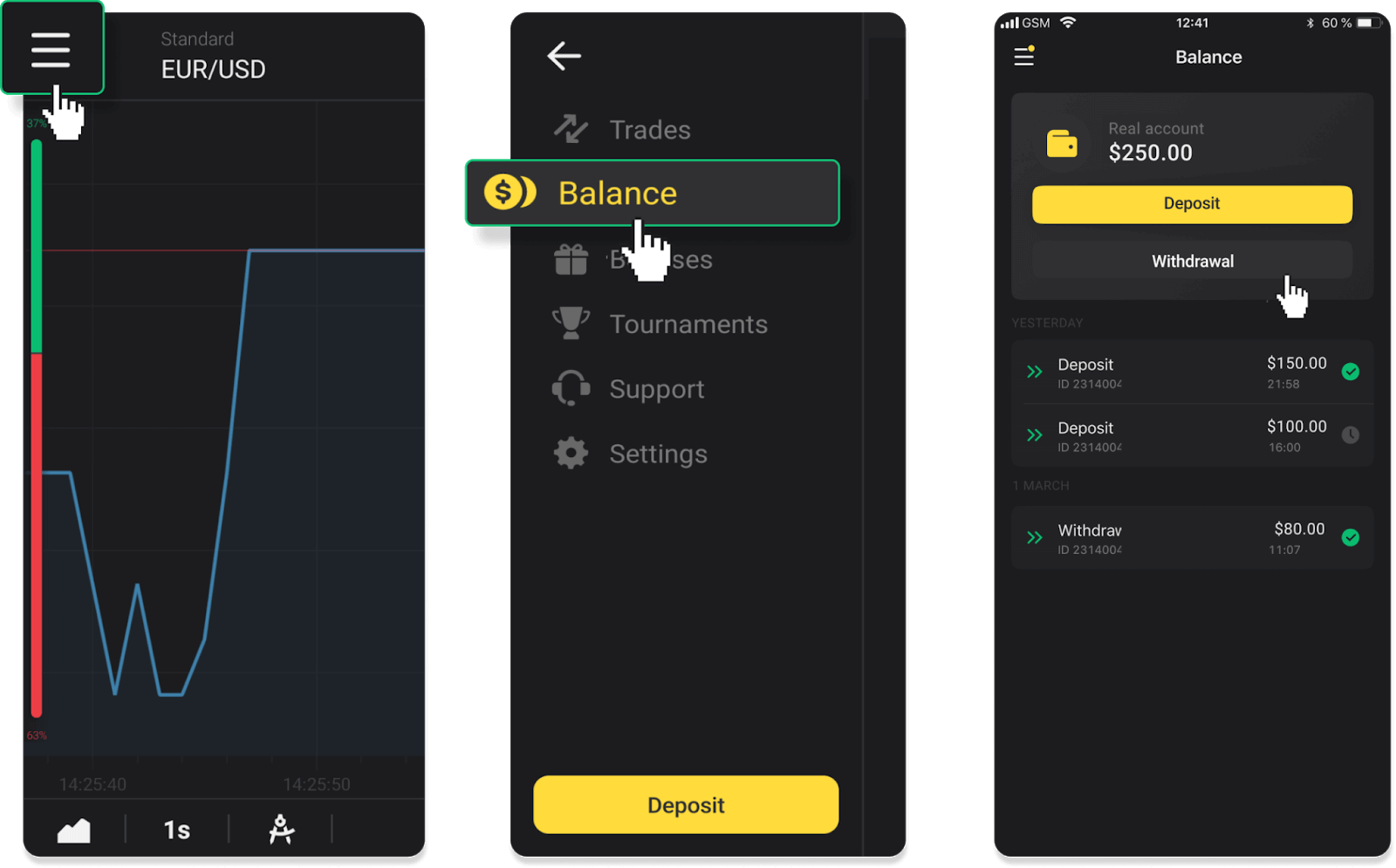

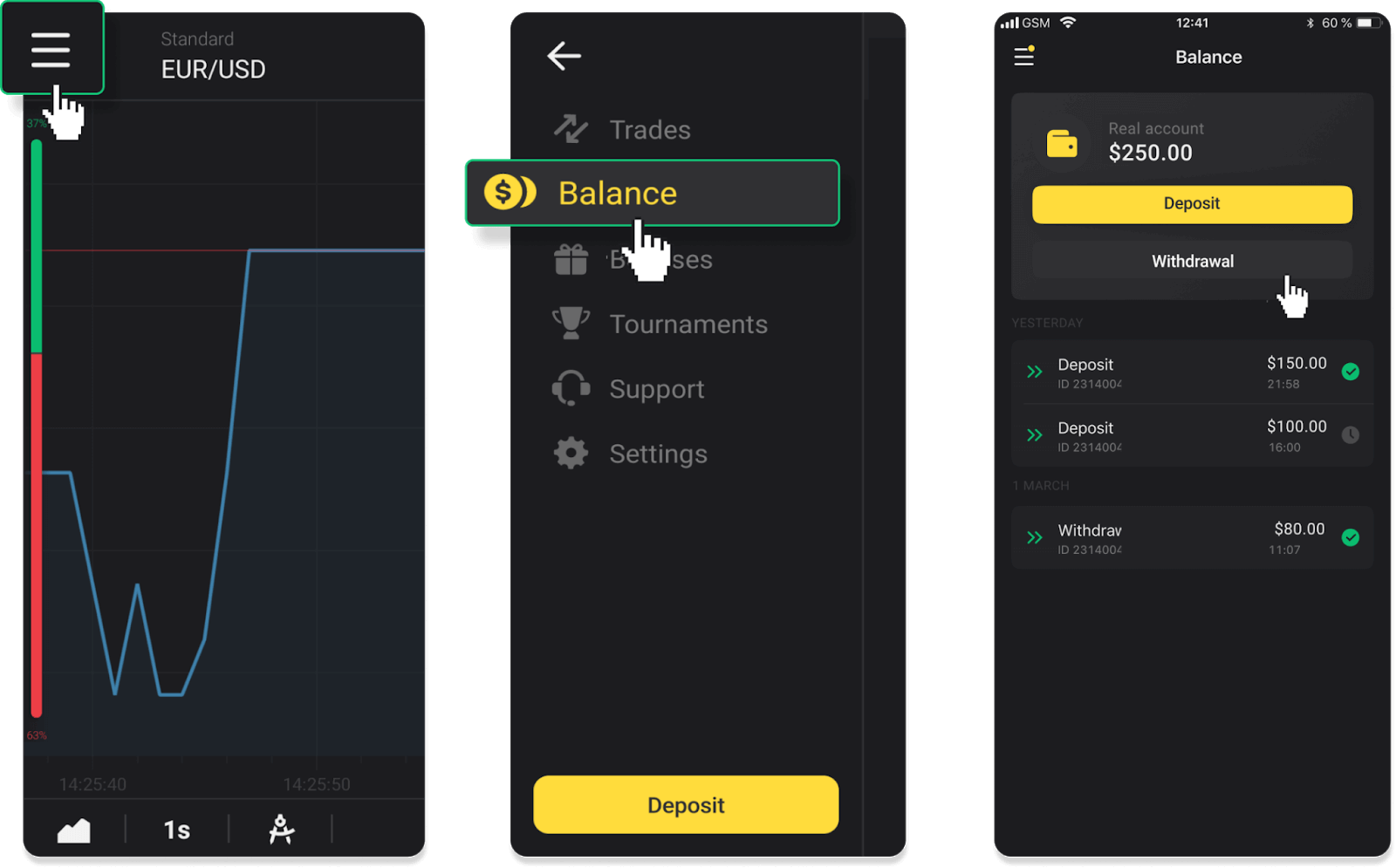

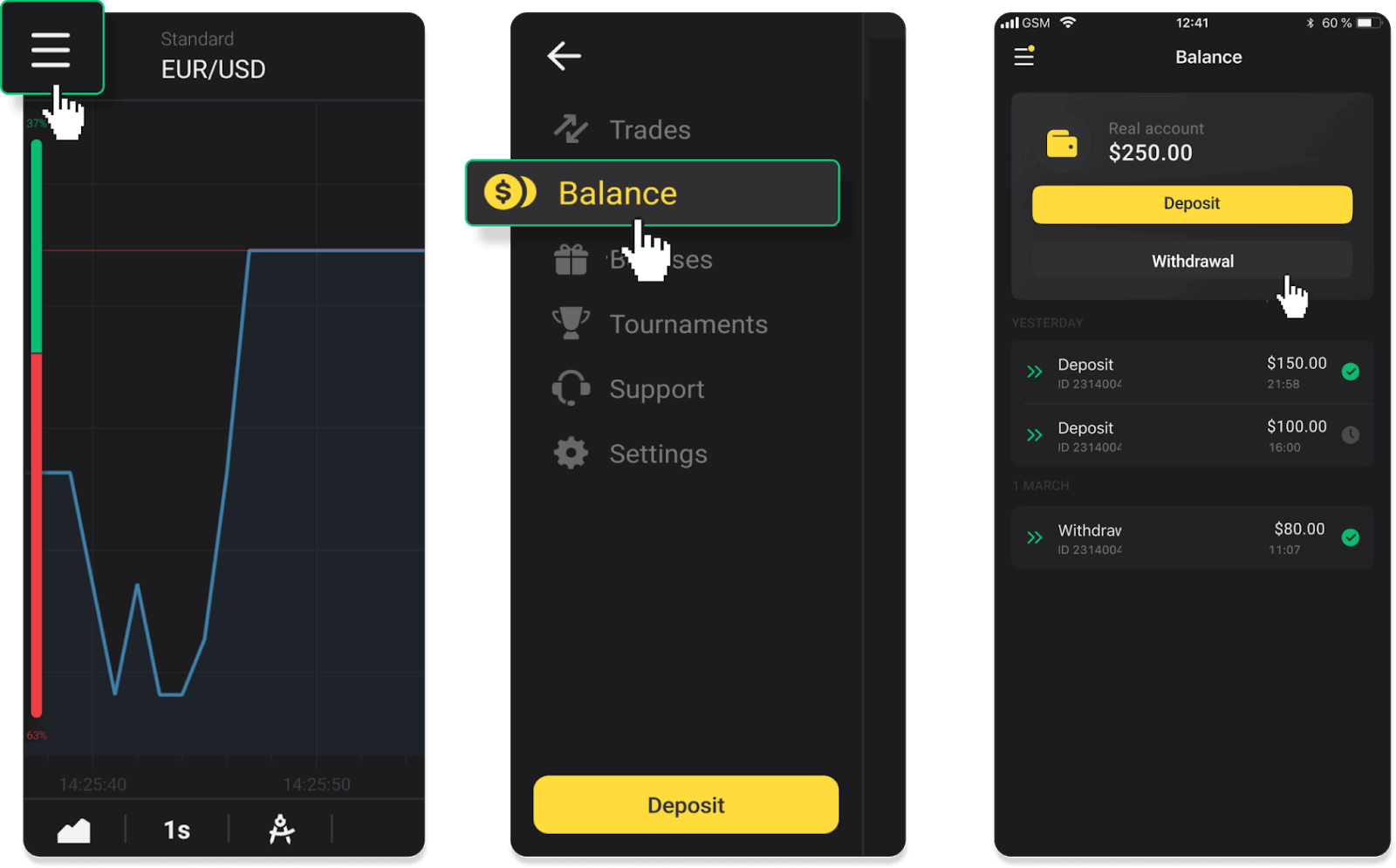

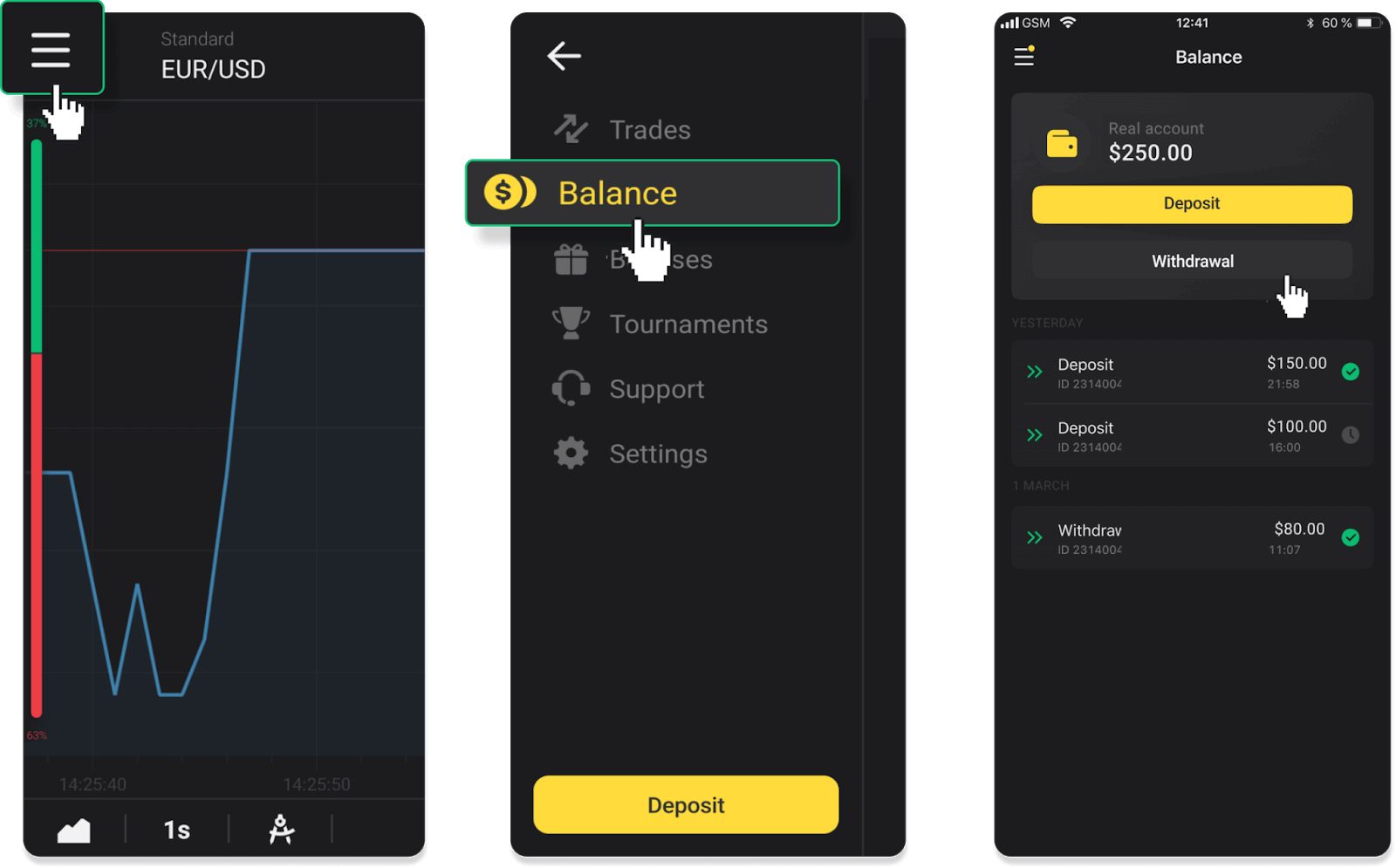

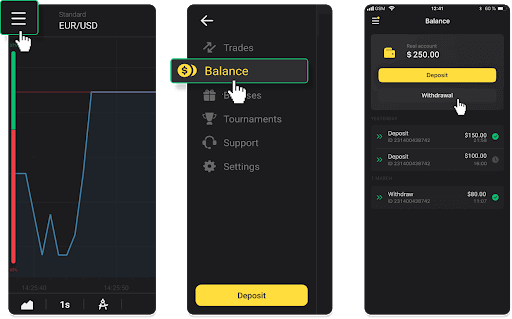

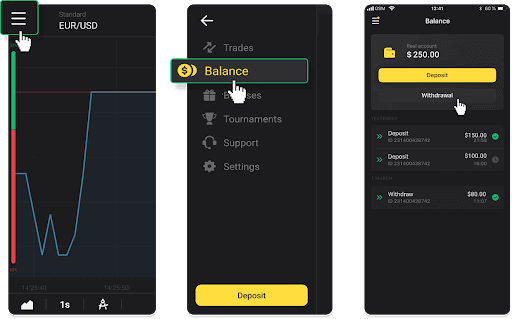

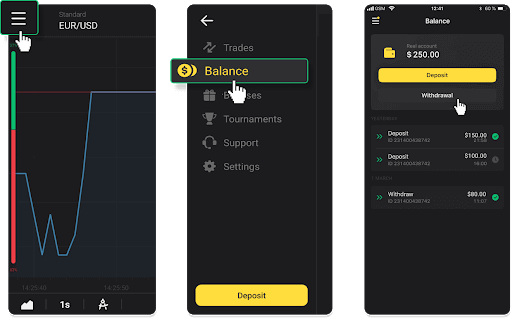

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

In the new Android app version: tap on the “Profile” icon at the bottom of the platform. Tap on the “Balance” tab and then tap “Withdrawal”.

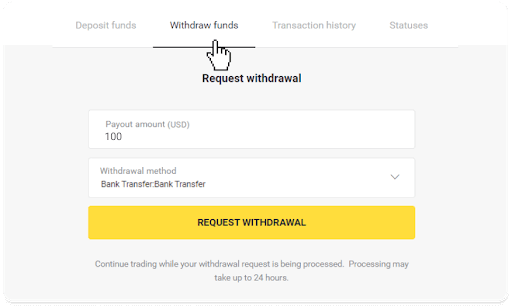

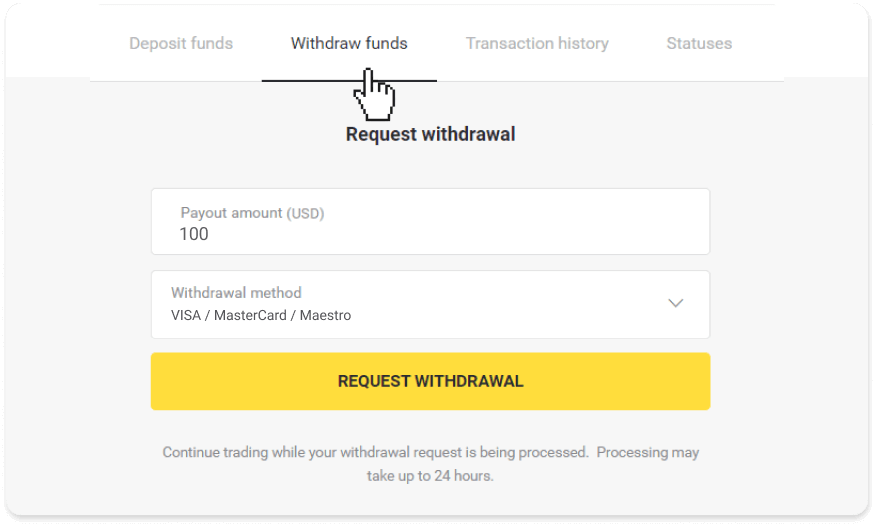

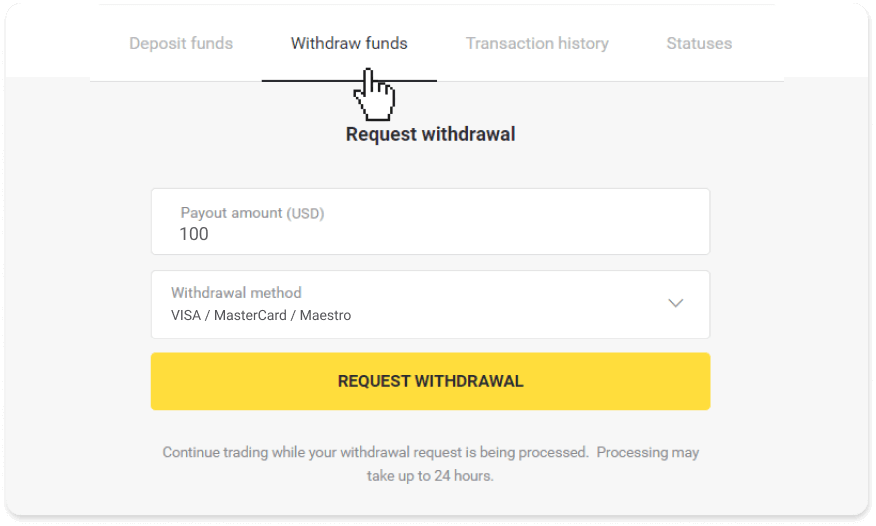

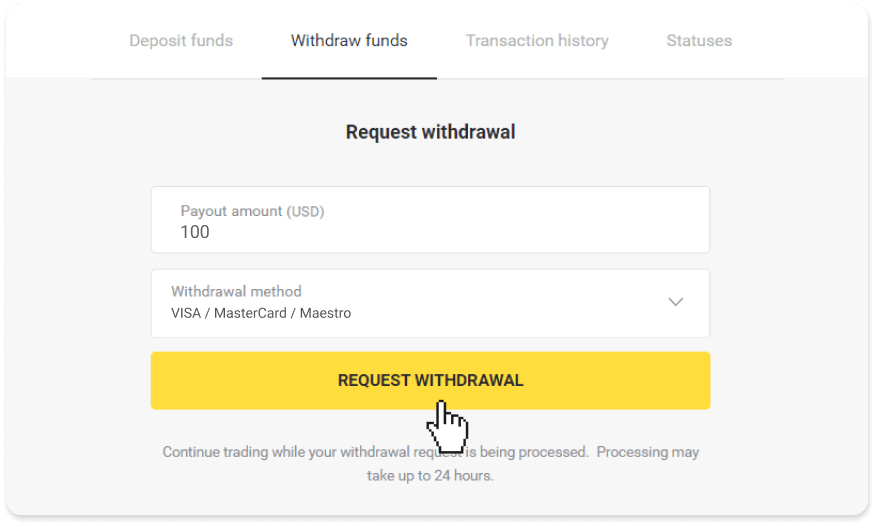

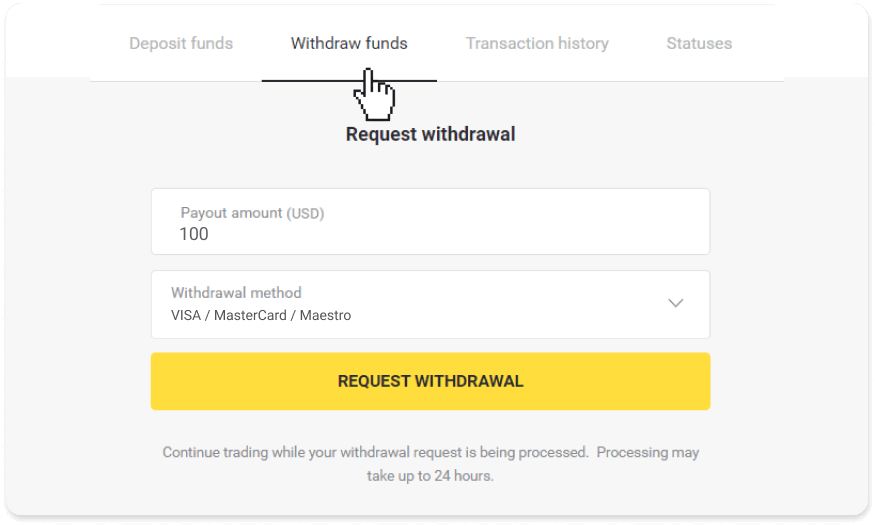

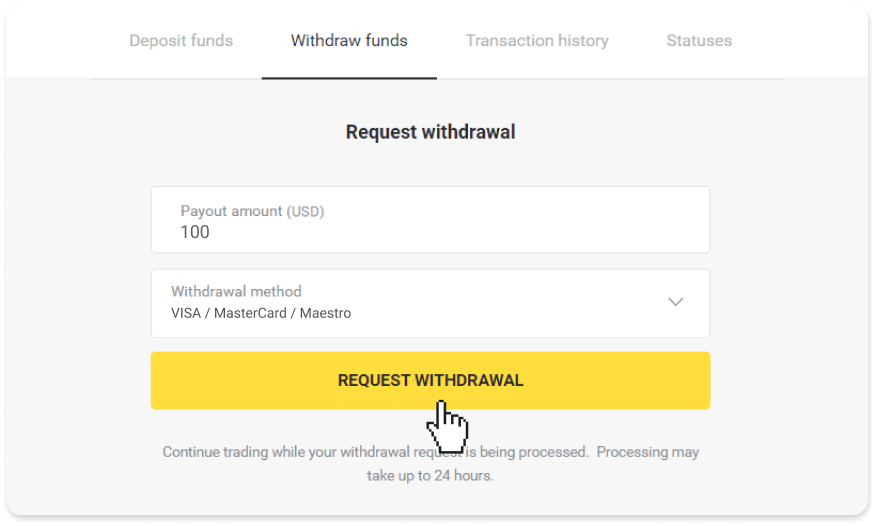

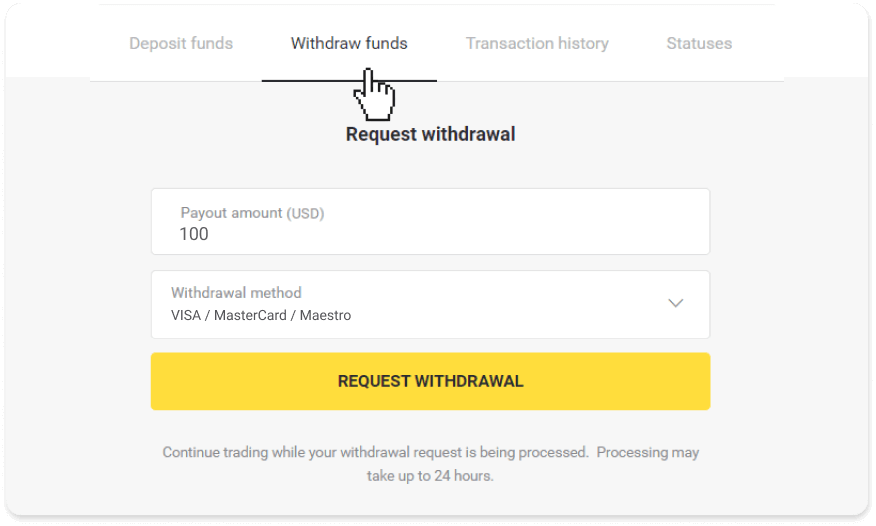

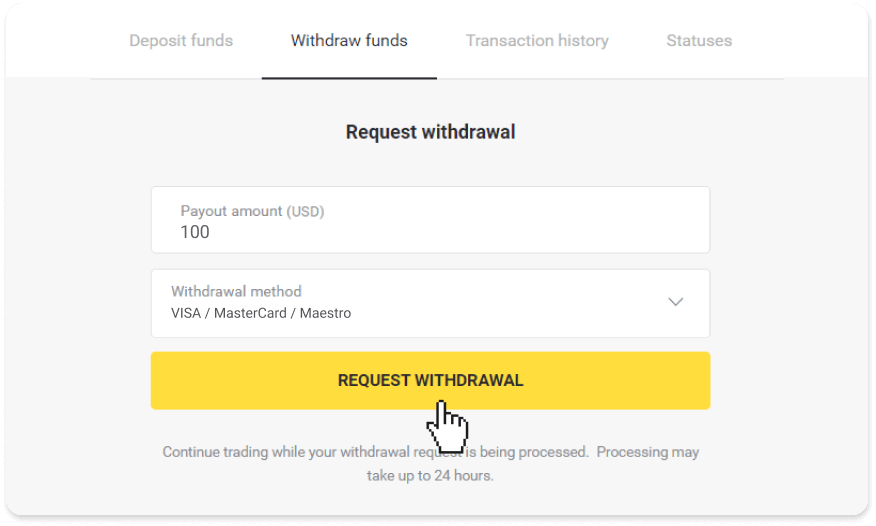

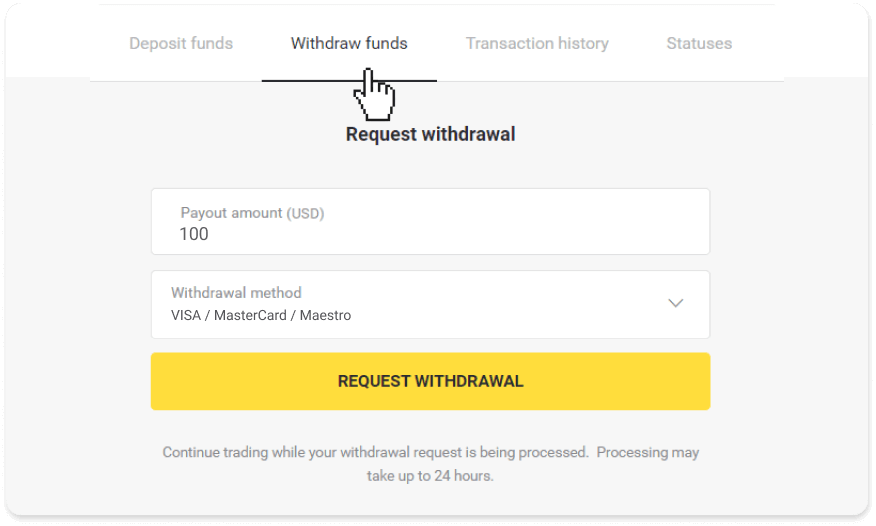

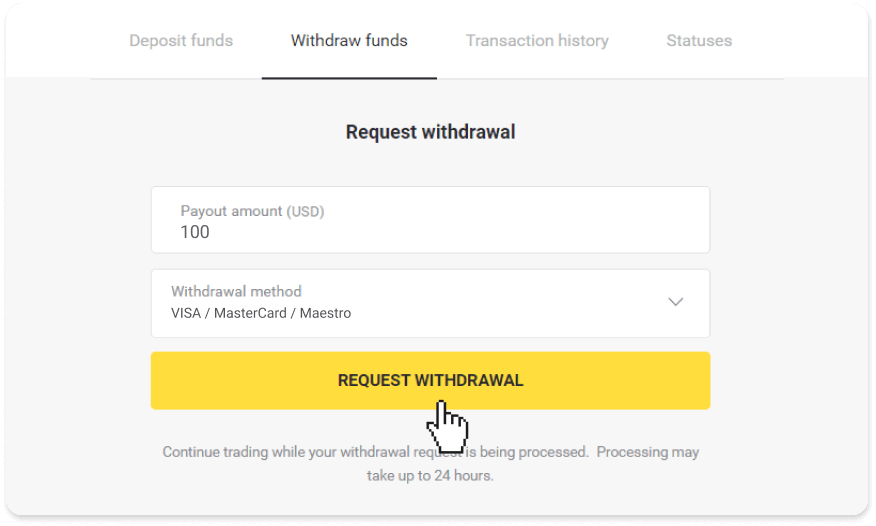

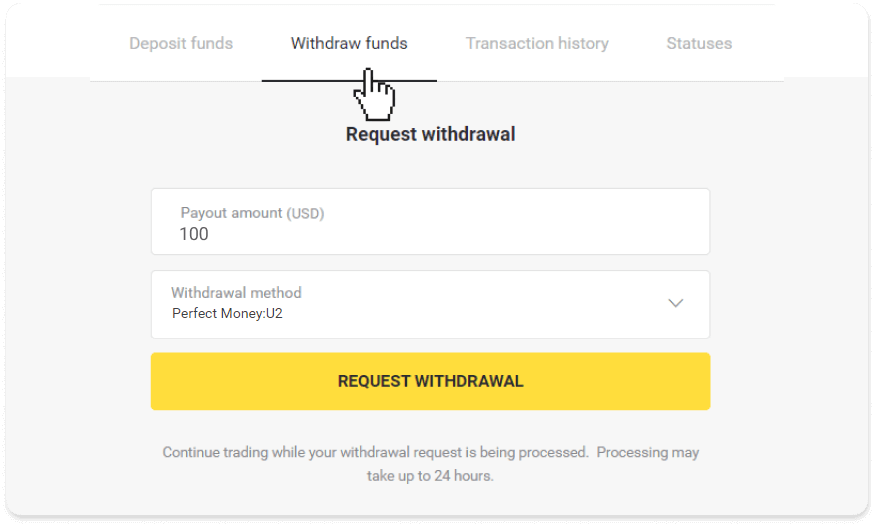

2. Enter the payout amount and choose “Bank transfer” as your withdrawal method. Fill in the rest of the fields (you can find all the required information in your bank agreement or in a bank app). Click “Request withdrawal”.

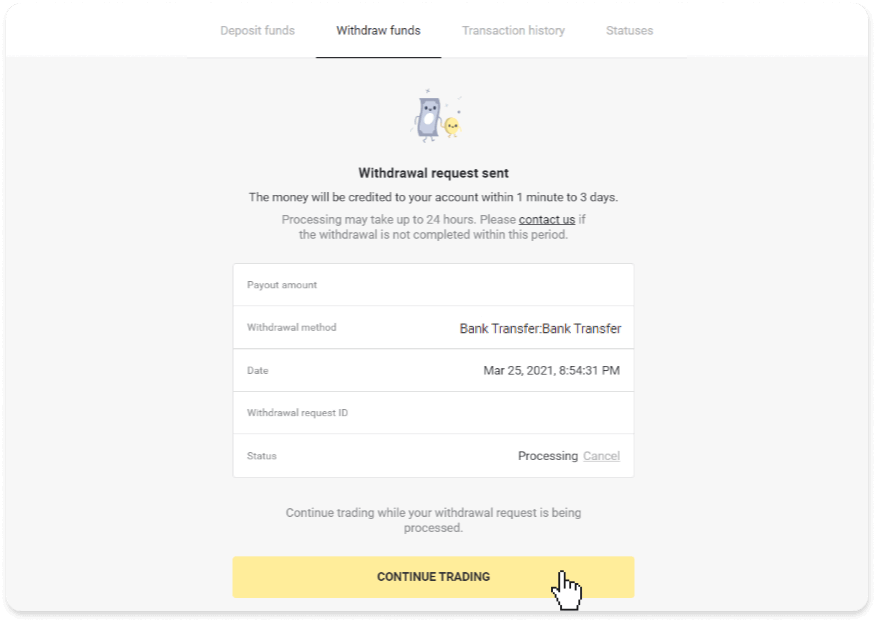

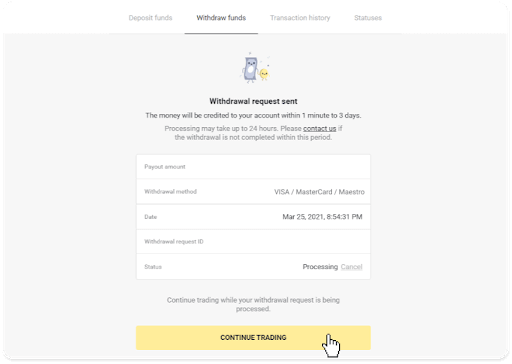

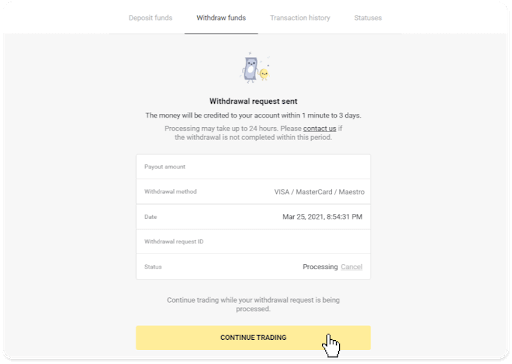

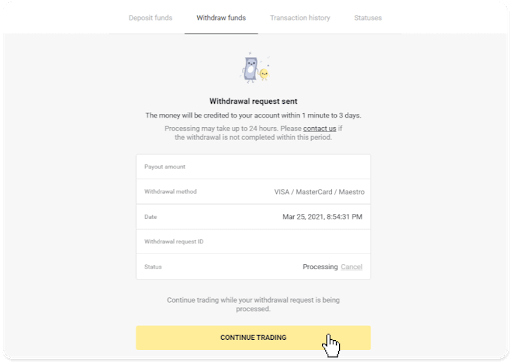

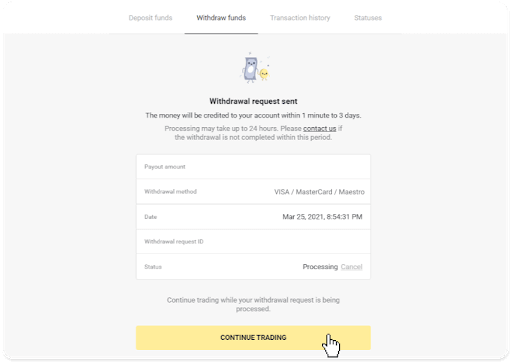

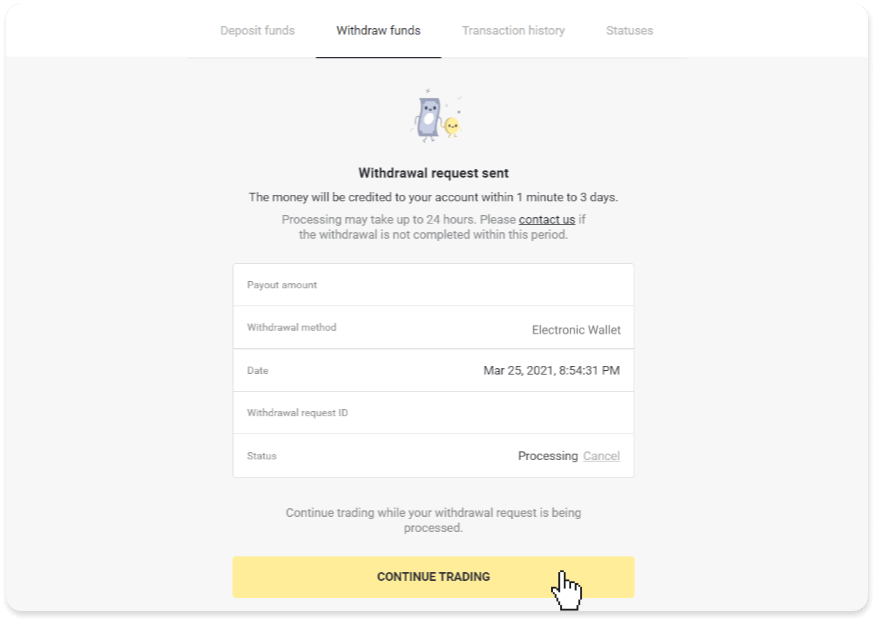

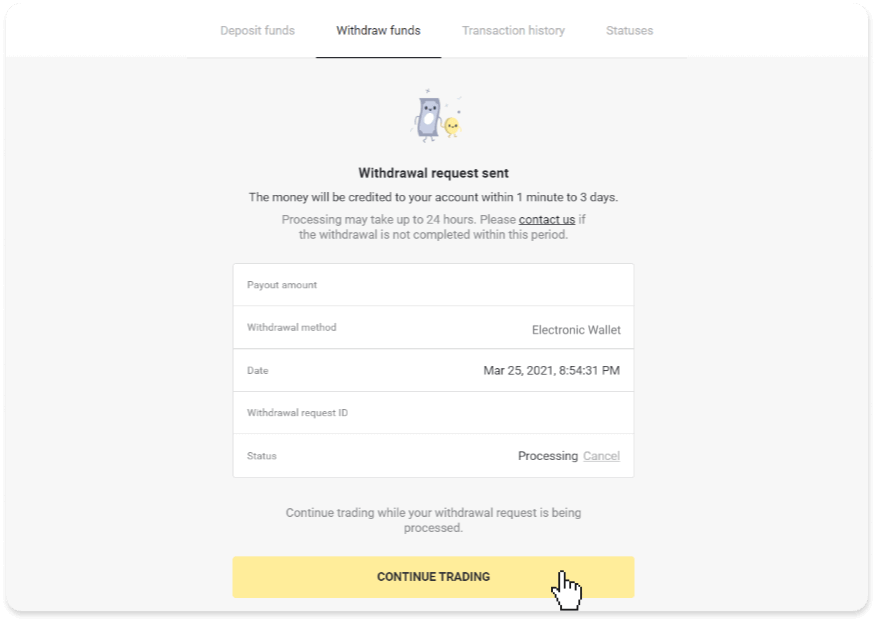

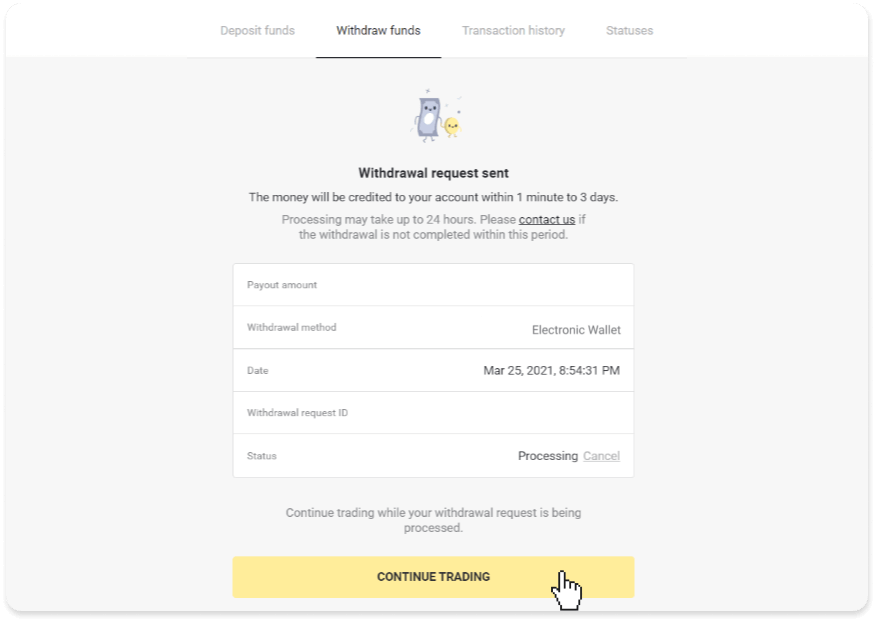

3. Your request is confirmed! You can continue trading while we process your withdrawal.

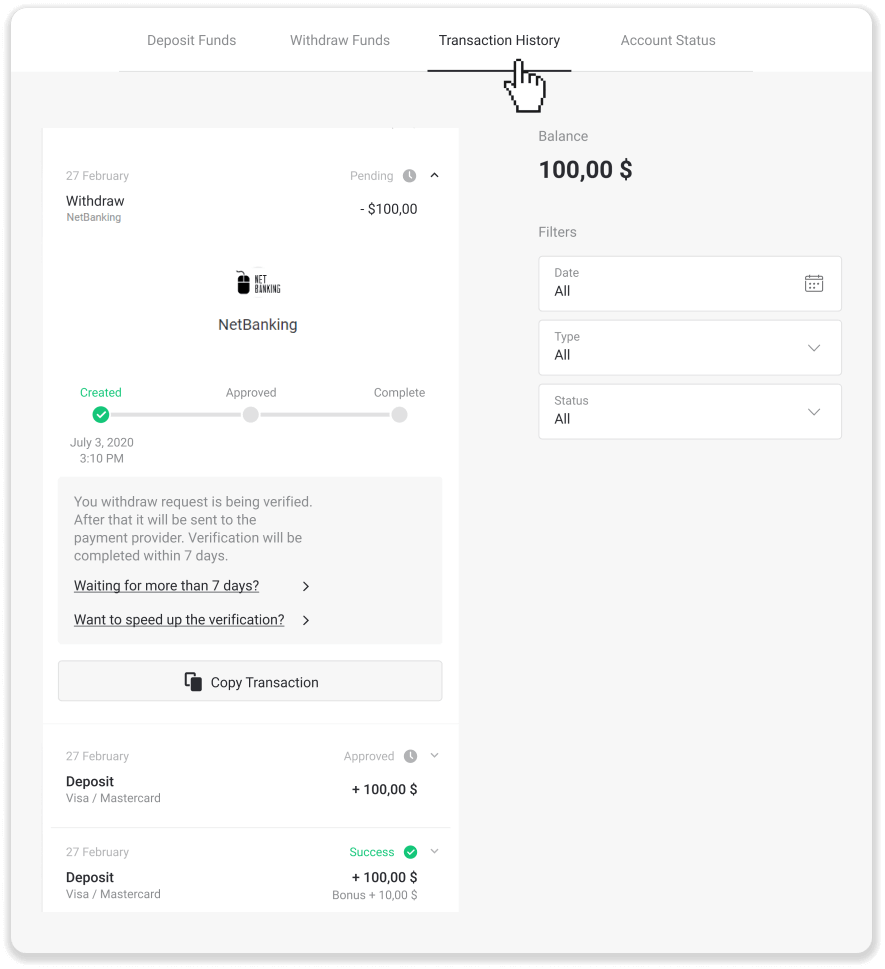

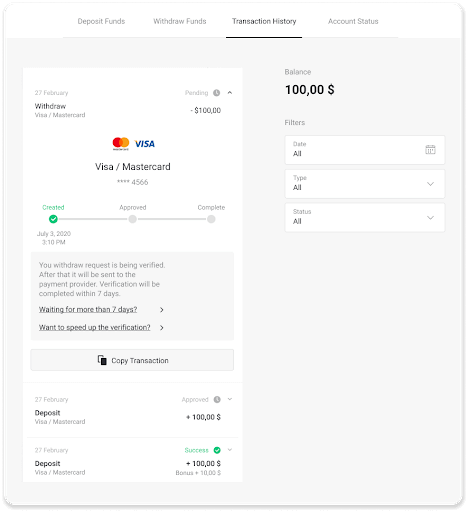

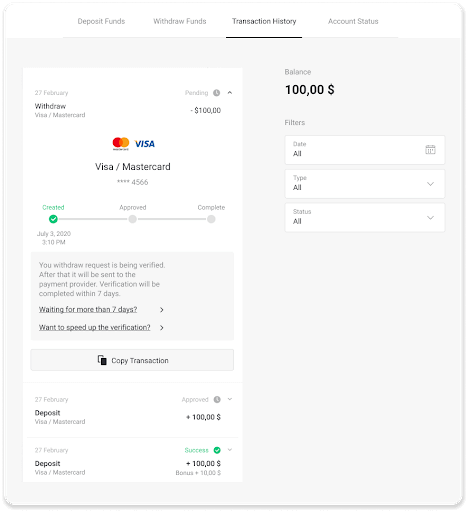

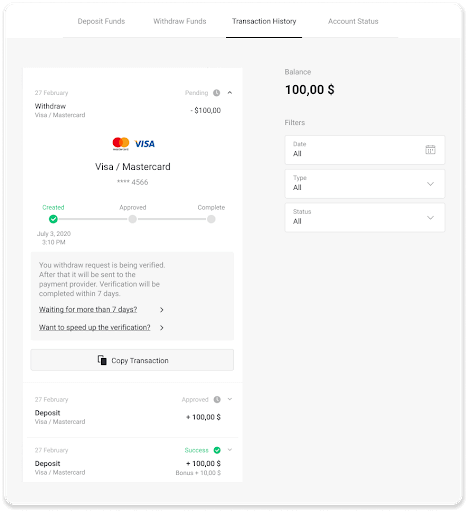

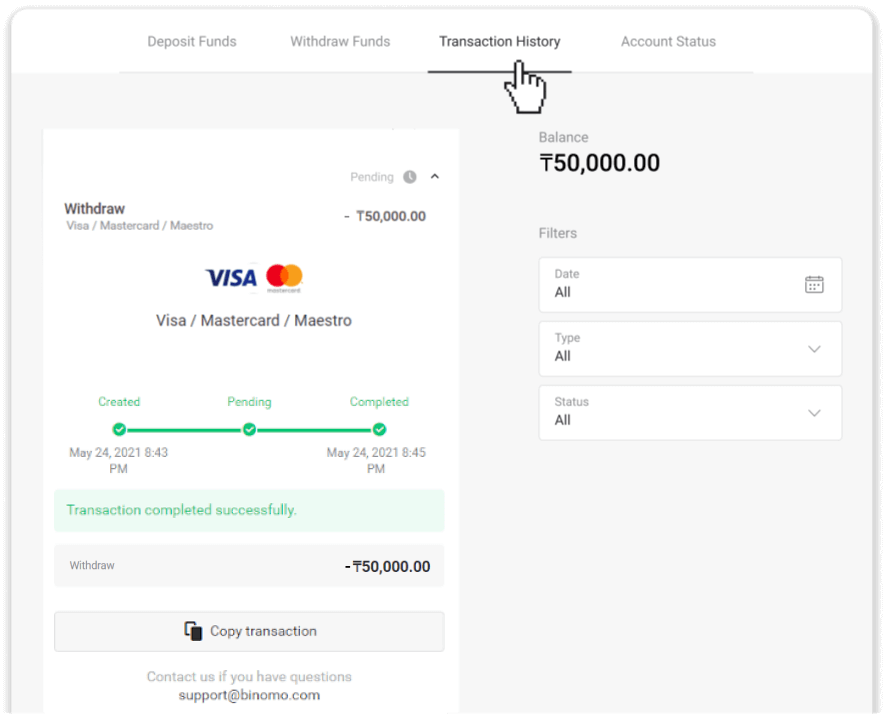

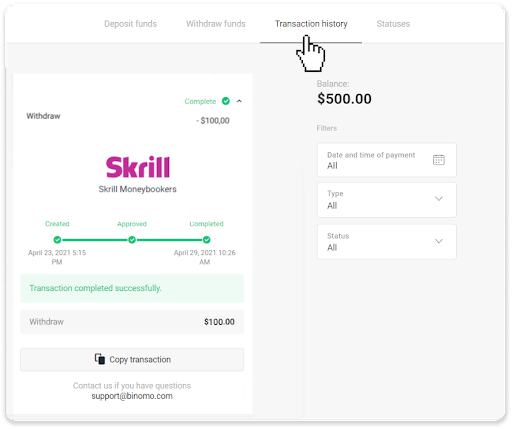

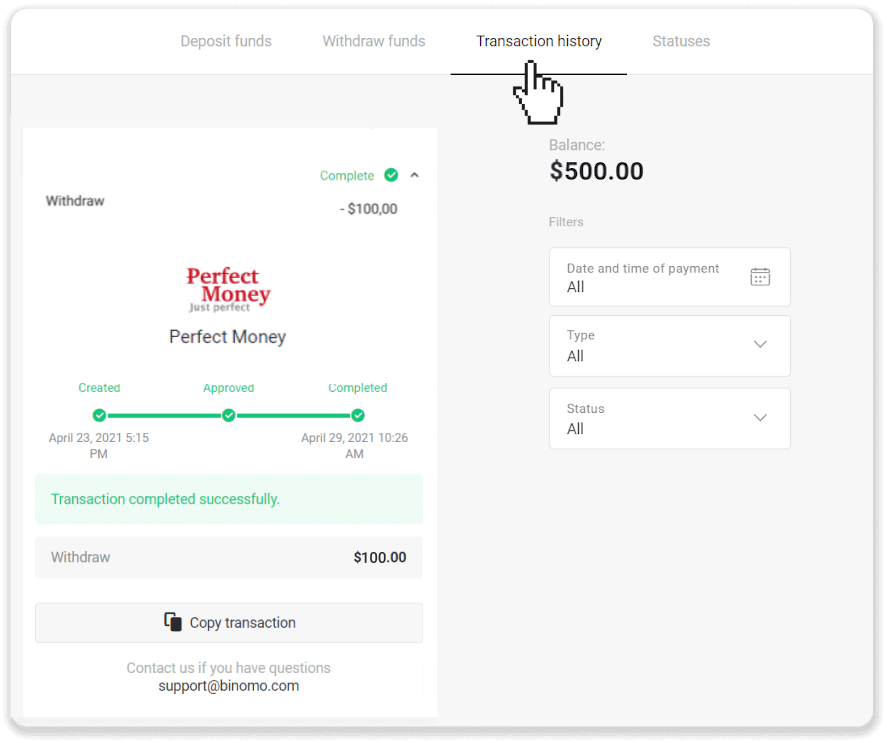

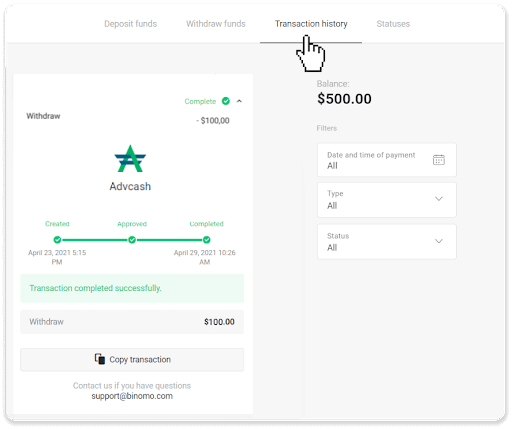

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers from 1 to 3 business days to credit funds to your bank account. In rare cases, this period may be extended up to 7 business days due to national holidays, your bank’s policy, etc.

If you’re waiting longer than 7 days, please, contact us in the live chat or write to [email protected]. We will help you track your withdrawal.

Withdraw funds from Binomo with Bank Card

Withdraw funds to a bank card

Withdrawals can be made using Visa/MasterCard/Maestro which are convenient and secure, plus there’s no commission.Bank card withdrawals are only available for cards issued in Ukraine or Kazakhstan.

To withdraw funds to a bank card, you’ll need to follow these steps:

1. Go to the withdrawal in the “Cashier” section.

In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section. Tap the “Withdrawal” button.

2. Enter the payout amount and choose “VISA/MasterCard/Maestro” as your withdrawal method. Fill in the required information. Please note that you can only withdraw funds to the bank cards you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers from 1 to 12 hours to credit funds to your bank card. In rare cases, this period may be extended up to 7 business days due to national holidays, your bank’s policy, etc.

If you’re waiting longer than 7 days, please, contact us in the live chat or write to [email protected]. We will help you track your withdrawal.

Withdraw funds to a non-personalized bank card

Non-personalized bank cards don’t specify the cardholder’s name, but you can still use them to credit and withdraw funds.Regardless of what it says on the card (for example, Momentum R or Card Holder), enter the cardholder’s name as stated in the bank agreement.

Bank card withdrawals are only available for cards issued in Ukraine or Kazakhstan.

To withdraw funds to a non-personalized bank card, you’ll need to follow these steps:

1. Go to the withdrawal in the “Cashier” section.

In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “VISA/MasterCard/Maestro” as your withdrawal method. Fill in the required information. Please note that you can only withdraw funds to the bank cards you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers from 1 to 12 hours to credit funds to your bank card. In rare cases, this period may be extended up to 7 business days due to national holidays, your bank’s policy, etc.

If you’re waiting longer than 7 days, please, contact us in the live chat or write to [email protected] We will help you track your withdrawal.

Withdraw in Ukraine via Visa / MasterCard / Maestro

To withdraw funds to your bank card, you’ll need to follow these steps:1. Go to the withdrawal in the “Cashier” section.

In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “VISA/MasterCard/Maestro” as your withdrawal method. Please note that you can only withdraw funds to the bank cards you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers from 1 to 12 hours to credit funds to your bank card. In rare cases, this period may be extended up to 7 business days due to national holidays, your bank’s policy, etc.

Withdraw in Kazakhstan via VISA / MasterCard / Maestro

To withdraw funds to your bank card, you’ll need to follow these steps:1. Go to the withdrawal in the “Cashier” section.

In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “VISA/MasterCard/Maestro” as your withdrawal method. Please note that you can only withdraw funds to the bank cards you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers from 1 to 12 hours to credit funds to your bank card. In rare cases, this period may be extended up to 7 business days due to national holidays, your bank’s policy, etc.

Withdraw funds from Binomo with Electronic Wallet

On the Withdrawal page, choose a digital wallet option from the “Withdrawal Method” box to proceed with your request and follow the onscreen instructions.Withdraw funds via Skrill

1. Go to the withdrawal in the “Cashier” section.In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “Skrill” as your withdrawal method and fill in your email address. Please note that you can only withdraw funds to the wallets you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers up to 1 hour to credit funds to your e-wallet. In rare cases, this period may be extended to 7 business days due to national holidays, your payment provider’s policy, etc.

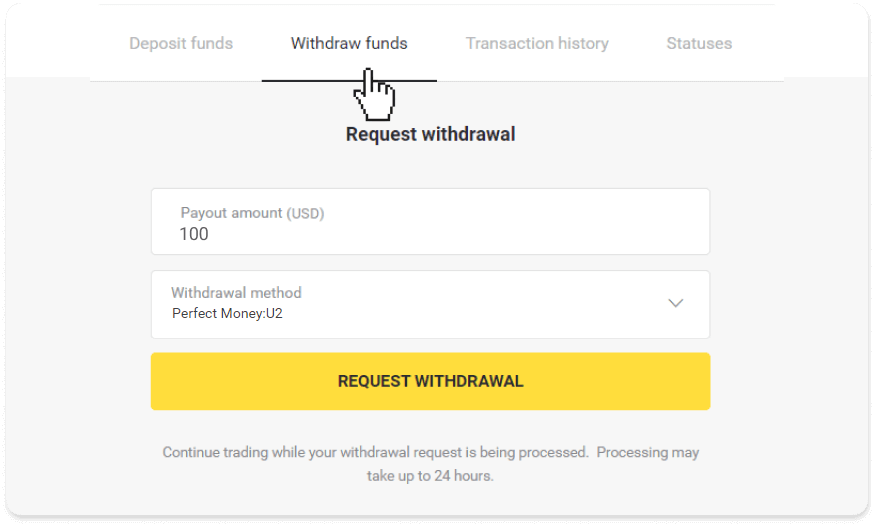

Withdraw funds via Perfect Money

Go to the withdrawal in the “Cashier” section.In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “Perfect Money” as your withdrawal method. Please note that you can only withdraw funds to the wallets you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers up to 1 hour to credit funds to your e-wallet. In rare cases, this period may be extended to 7 business days due to national holidays, your payment provider’s policy, etc.

Withdraw funds via ADV cash

1. Go to the withdrawal in the “Cashier” section.In the web version: Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu.

Then click the “Withdraw funds” tab.

In the mobile app: Open a left side menu, choose the “Balance” section, and tap the “Withdraw” button.

2. Enter the payout amount and choose “ADV cash” as your withdrawal method. Please note that you can only withdraw funds to the wallets you’ve already made a deposit with. Click “Request withdrawal”.

3. Your request is confirmed! You can continue trading while we process your withdrawal.

4. You can always track the status of your withdrawal in the “Cashier” section, “Transaction history” tab (“Balance” section for the mobile app users).

Note. It usually takes payment providers up to 1 hour to credit funds to your e-wallet. In rare cases, this period may be extended to 7 business days due to national holidays, your payment provider’s policy, etc.

Frequently Asked Questions (FAQ)

What payment methods can I use to withdraw funds?

You can withdraw funds to your bank card, bank account, e-wallet, or crypto-wallet.

However, there are a few exceptions.

Withdrawals directly to a bank card are only available for cards issued in Ukraine or Turkey. If you are not from these countries, you can withdraw to your bank account, an e-wallet, or a crypto-wallet. We recommend using bank accounts that are linked to cards. This way, the funds will be credited to your bank card. Bank account withdrawals are available if your bank is in India, Indonesia, Turkey, Vietnam, South Africa, Mexico, and Pakistan.

Withdrawals to e-wallets are available for every trader who has made a deposit.

Why can’t I receive funds right after I request a withdrawal?

When you request a withdrawal, first, it gets approved by our Support team. The duration of this process depends on your account status, but we always try to shorten these periods when possible. Please note that once you’ve requested a withdrawal, it cannot be canceled.

- For standard status traders, the approval might take up to 3 days.

- For gold status traders – up to 24 hours.

- For VIP status traders – up to 4 hours.

Note. If you haven’t passed verification, these periods can be extended.

To help us approve your request faster, before withdrawing make sure that you don’t have an active bonus with a trading turnover.

Once your withdrawal request is approved, we transfer it to your payment service provider.

It usually takes payment providers from a few minutes to 3 business days to credit funds to your payment method. In rare cases, it can take up to 7 days due to national holidays, payment provider’s policy, etc.

If you’re waiting longer than 7 days, please, contact us in the live chat or write to [email protected]. We will help you track your withdrawal.

What is the minimum and maximum withdrawal limit?

The minimum withdrawal limit is $10/€10 or an equivalent of $10 in your account currency.The maximum withdrawal amount is:

- Per day: no more than $3,000/€3,000, or an amount equivalent to $3,000.

- Per week: no more than $10,000/€10,000, or an amount equivalent to $10,000.

- Per month: no more than $40,000/€40,000, or an amount equivalent to $40,000.

How much time does it take for funds to be withdrawn?

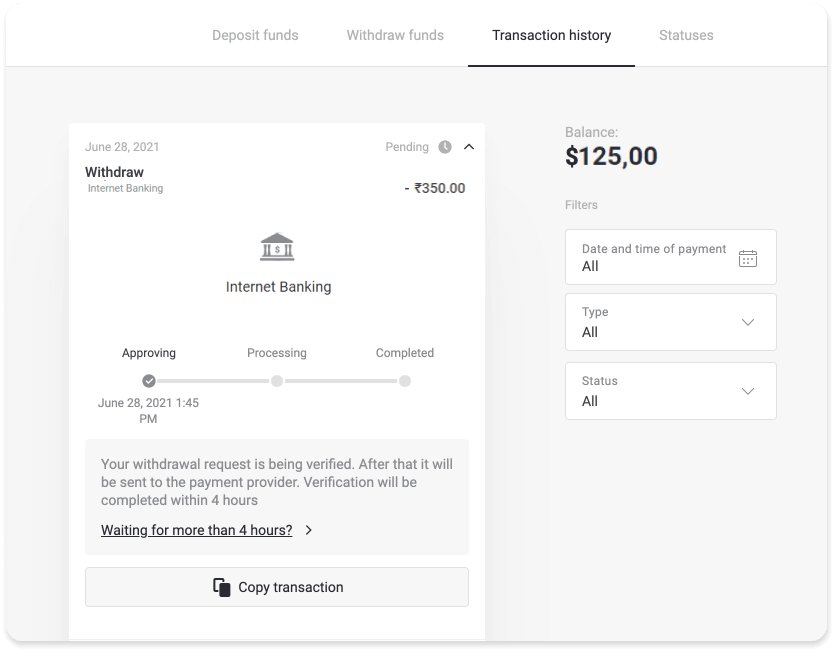

When you withdraw funds, your request goes through 3 stages:

- We approve your withdrawal request and pass it on to the payment provider.

- The payment provider processes your withdrawal.

- You receive your funds.

It usually takes payment providers from a few minutes to 3 business days to credit funds to your payment method. In rare cases, it can take up to 7 days due to national holidays, payment provider’s policy, etc. Detailed information regarding the withdrawal conditions is denoted in 5.8 of the Client Agreement.

Approval period

Once you send us a withdrawal request, it gets assigned with “Approving” status (“Pending” status in some mobile application versions). We try to approve all withdrawal requests as fast as possible. The duration of this process depends on your status and is indicated in the “Transaction History” section.

1. Click on your profile picture in the top right corner of the screen and choose the “Cashier” tab in the menu. Then click the “Transaction history” tab. For mobile app users: open the left side menu, choose the “Balance” section.

2. Click on your withdrawal. The approval period for your transaction will be indicated.

If your request is being approved for too long, contact us by clicking “Waiting for more than N days?” (“Contact support” button for mobile app users). We will try to figure out the problem and speed up the process.

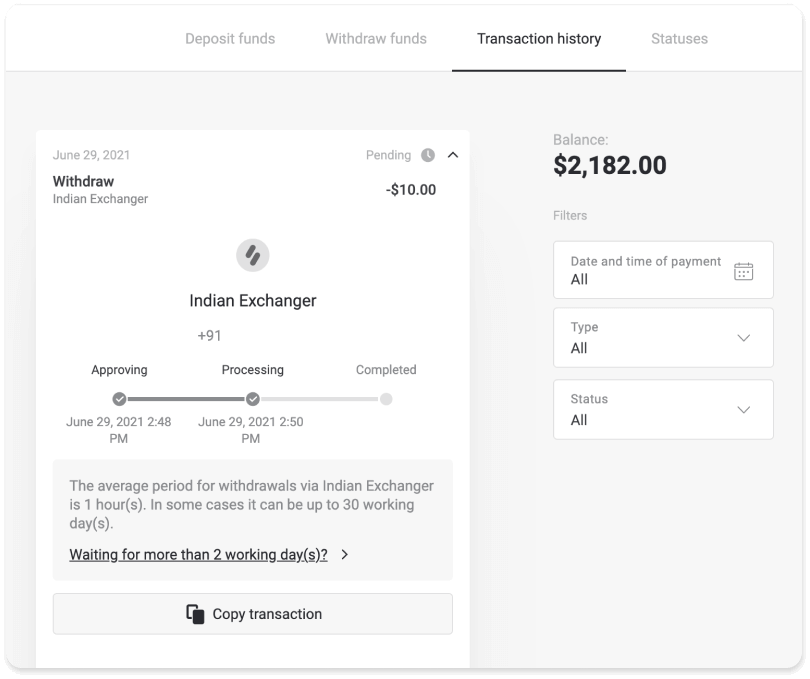

Processing period

After we’ve approved your transaction, we transfer it to the payment provider for further processing. It gets assigned with “Processing” status (“Approved” status in some mobile application versions).

Each payment provider has its own processing period. Click on your deposit in the “Transaction History” section to find the information about the average transaction processing time (generally relevant), and the maximum transaction processing time (relevant in the minority of cases).

If your request is being processed for too long, click “Waiting for more than N days?” (“Contact support” button for mobile app users). We will track your withdrawal and help you to get your funds as soon as possible.

Note. It usually takes payment providers from a few minutes to 3 business days to credit funds to your payment method. In rare cases, it can take up to 7 days due to national holidays, payment provider’s policy, etc.